Note from the Editor:

From the author of 'Total

Retail Loss', Professor Adrian Beck has written a

new paper that offers his perspective on how the COVID-19 Pandemic might be

impacting upon the world of Loss Prevention.

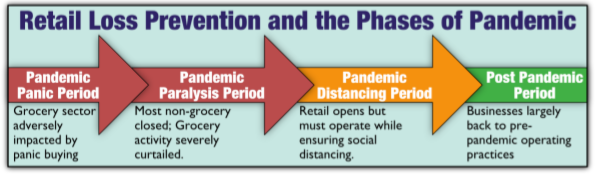

He starts by identifying what he sees as the four phases of the Pandemic - from

the initial Panic Buying period, through the lockdown phase when most retail was

shuttered, on to the current social distancing period, and finally the

post-pandemic phase. At each stage he offers his insights on how retail losses

and their management might be impacted, both negatively and positively.

Professor Beck's paper offers a refreshing counterbalance to some of the more

doom-laden commentaries on the likely consequences of the Pandemic on retail

losses, noting that the unprecedented nature of the event requires a much more

considered and cautious approach to be adopted.

An incredibly instinctive read, well worth your investment. Just our thoughts.

-Gus Downing

Some Reflections on Retail Loss Prevention in a Time of COVID-19

By

Adrian Beck

By

Adrian Beck

Emeritus Professor at University of Leicester

Much has already been written and spoken about the likely impact of the COVID-19

Pandemic on the retail sector in general and loss prevention in particular -

perhaps the price we pay for too many people working from home with time on

their hands! I have heard sweeping and largely data-free assertions being made

about how retail losses will dramatically increase: shop theft will go up, Organised Retail Crime will get much worse, staff will steal more, fraud will go

through the roof, and so on. In addition, there is considerable speculation that

what is happening now will become the 'new' normal - everything has changed and

nothing will be the same again.

Now, some of this may be 'true' although how anybody actually knows is very

unclear at this stage of the Pandemic, not least because in some countries at

least, many non-food retail stores still remain closed or are just beginning the

slow process of restarting. In many respects, it reminds me of the apocryphal

quote attributed to the Chinese PM in the 1970s, Zhou Enlai, when asked about

the impact of the French Revolution in the 18th Century, he said: 'it was too

early to say'. I can certainly recall similar sentiments about things never

being the same again after 9/11 and the economic crash in 2008, and while these

events have not, and should not be forgotten, their lasting impact has

undoubtedly faded over time.

Given all of this, I am going to only offer some very tentative thoughts on how

I think retail loss prevention has been impacted by current events and a few

reflections on emerging issues and what the future may hold. This is based

primarily upon a number of non-representative online discussions with loss

prevention leaders associated with the ECR Retail Loss Group. For the most part,

they represent the Grocery industry in Europe.

Pandemic Phases

What now seems to be coming clear is that the retail industry is likely to

experience four phases of impact from the COVID-19 Pandemic:

Phase 1: Pandemic Panic Period

We are all now familiar with the scenes of panic buying seen across the world,

where the Grocery sector was hit with the equivalence of sustained peak festive

buying patterns across several weeks in late February, early March 2020. Shelves

stripped bare of 'essentials' such as toilet rolls, sanitisers, pasta, flour and

so on. But, unlike the predictability of the established seasonal peaks, Grocers

and their supply chains were simply overwhelmed for a period of time, with

heavily overcrowded stores unable to maintain established working practices

Likely Impact on Retail Loss and its Control

Levels of unexplained loss in this period are likely to have increased

substantially due to:

•

Loss of control over inventory records as stock is rushed into stores at

breakneck speed.

•

Shoppers/thieves taking advantage of the chaos/overly full stores to commit

theft, including push

out thefts.

•

Abuse of self-scan systems as customers take advantage of the inability for

stores to maintain any form of control/undertake checks. Indeed, some retailers

simply turned off all their SCO controls to ease overcrowding/increase

throughput of customers. It is hard to imagine what the losses are likely to

have been from Scan and Go/Mobile SCO systems where the capacity to undertake

any form of audit check was severely curtailed.

•

Use of product tagging suspended by some retailers due to volume of product and

lack of available staff time to apply them.

•

Increased product damage as large volumes of stock are quickly moved through the

supply chain.

•

Staff theft (cash and produce) made easier by the relaxation of controls and the

chaotic environment.

•

Influx of new staff brought into businesses to cope with the increased demand

who have not been properly vetted and/or correctly trained, leading to increased

theft and errors.

For many Loss Prevention teams, they were likely to have been largely side

lined/reallocated to stores to try and manage the massive increase in demand -

the primary focus of the business - with concerns about associated losses simply

parked for review at a later date. In addition, expenditure on guarding was

dramatically increased to try and ensure some form of crowd control.

Thankfully, this period of Pandemic Panic only lasted a few weeks, as countries

began to impose more draconian controls over their citizenry, dramatically

curtailing where they could go and what they could do. This gave Grocers the

opportunity to replenish their supply chains and stores and fully engage their

Crisis Management plans - for some UK Grocers, the extended planning for Brexit

undoubtedly helped considerably in this respect.

Phase 2 Pandemic Paralysis Period

As Governments enforced varying degrees of lockdown, most parts of retailing

other than food related, were forced to close their physical stores, turning

once vibrant town centres and shopping centres into ghost towns. For the food

sector, the panic buying period was over but they had to adapt their stores to

deliver a more controlled socially isolating shopping experience.

Likely Impact on Retail Loss and its Control

It is unclear whether the UK Home Secretary was being ironic when she rather

proudly claimed that a positive impact of the lockdown was a massive reduction

in the number of incidents of shop theft reported to the police - who would of

thought closing all the retail stores would have such an effect! Obviously, for

those retailers that no longer had stores open, then their losses from external

theft largely went away - no customers, no shop theft. It is a dizzyingly

brilliant way to curb these losses, but it comes at a rather profound cost to

the health of the business. However, shuttered stores full of unsold stock in

now deserted parts of city centres offer a potentially attractive target for

burglars and so it is likely that this posed an increased risk at this time.

For Grocers, it is likely that the risk from external theft was decreased in

this period, for the following two main reasons:

•

Strict limits on the number of customers allowed in a store at any one time,

with one way systems often in place to regiment their flow through the building.

Typically shop thieves thrive in busy environments that offer a high degree of

anonymity and cover.

•

High levels of human control at exits and entrances making push out thefts in

particular highly risky.

In terms of internal theft, then it is hard to know - its prevalence could be

impacted positively and negatively. One argument goes that it will increase

because, amongst other reasons, staff feel justified in stealing because their

employer is not recompensing them sufficiently for the risky environment they

are asking them to work in. A counter argument is that staff are much less

likely to steal because if they are caught and lose their job, then the prospect

of getting other work at this time will be extremely challenging. Another

argument is that as the flow of goods through supermarkets is now much more

regulated, with fewer peaks and troughs, backroom areas are now less cluttered,

therefore offering fewer opportunities for thefts to take place.

It is of course impossible to know at this time and any comparisons between data

before, during and after the COVID Pandemic are likely to be riven with

methodological problems. For instance, one loss prevention leader declared that

incidents of staff theft had increased considerably since they had reallocated

their team of store detectives to focus upon the problem. It reminded me of the

wonderfully flawed measure of shop theft utilised by a now defunct retailer.

They relied upon the number of arrests by store detectives to act as their

barometer of shop theft. They were always baffled as to why they never had any

shop theft incidents on a Monday, until they finally took into account store

detective rotas - no store detectives at work, no shop theft incidents recorded!

Similarly, now having the resource to unearth more cases of employee theft does

not provide indicative data of a trend - merely that incidents are now being

uncovered that could have been happening before.

While most physical stores have been shuttered in this period, online sales have

continued for some retailers and claims have been made that losses associated

with this type of retailing will increase. While data on retail losses from

E-commerce are only beginning to emerge and my

Total Retail Loss Typology 2.0 began to capture what these losses might look

like, it is hard to begin to imagine why the COVID pandemic will necessarily

impact upon these types of losses. It could be that the increased volume of

orders makes credit checks harder to perform. It could mean that more orders

lead to more picking and packing errors perhaps. But equally, it could mean that

there are fewer incidents of theft from the delivery supply chain - chances of

nobody being at home are much reduced at a time of lockdown! It is hard to know

and while speculation is an inherent human trait, much more data and research is

required to understand what impact these times have had on e-commerce related

losses.

Phase 3: Pandemic Distancing

Period

So, we come to what can be regarded as the current phase - the reopening of most

forms of retailing albeit with a whole series of restrictive practices put in

place by governments and consumer expectations. The most dominant factor is the

requirement to deliver forms of social distancing wherever possible. This is

likely to create some extremely challenging financial problems for retailers and

have an impact upon the scale and control of retail losses.

Likely Impact on Retail Loss and its Control

With strict limits on the number of customers allowed in a store, then

opportunities for shop theft are likely to remain diminished - as mentioned

earlier, thieves prefer to operate under the cover of anonymity offered by

crowded stores. Equally, the active policing of entrances and exits will add a

further layer of security that is likely to amplify the sense of risk in those

tempted to steal. While there is some evidence that economically distressed

communities can see an uptick in crime, which may encourage more to try and

steal out of necessity, this is not as clear cut as some commentators would have

you believe.

Less positively, keeping control of self-scan related losses may prove more

challenging when staff are actively trying to maintain social distancing.

Responding to alerts at Fixed SCO machines will continue to represent a

challenge, especially where screens are introduced to provide a barrier between

customers. In addition, delivering audit checks on those using Scan and Go

systems will be difficult - will customers be willing to have staff rummaging

through their products looking for under or over scanned items? Losses are also

likely to be exacerbated by a higher number of users opting to shop using SCO

technologies.

Retailers could see an increase in aggressive confrontations between customers.

Unlike in the Pandemic Panic Period when unruly behavior was seemingly focused

upon who got the last pack of toilet roll (I hope somebody has started a PhD on

this topic), arguments may flare up relating to the extent to which social

distancing rules are being maintained.

In a similar vein, Loss Prevention teams will need to carefully review how they

will handle incidents of violence and the apprehension of shoplifters to ensure

staff and customers remain safe. Indeed, retail lawyers may already be preparing

their defense for COVID infection claims.

Social distancing rules may also impact upon the use of a range of reusable

security devices, such as hard tags and safer cases - will they need to be

regularly cleansed and can their removal at the checkout be done in a socially

distancing way? Time will tell.

Some retailers are already beginning to grapple with the thorny issue of

processing product returns and the handling of clothing in changing rooms. Any

additional process steps to 'cleanse' these products are likely to increase the

risks of damage, mark downs and internal theft opportunities.

Current evidence suggests that in a good number of countries the COVID-19

Pandemic has accelerated the use of non-cash ways of paying, particularly

contactless technologies. This in turn could therefore reduce losses of cash,

both by staff and by robbers. In addition, the costs of cash handling will also

be reduced.

In terms of internal theft, I have already rehearsed the arguments for and

against a change. For those companies that rely upon a staff searching regime,

then again this could be much more difficult to deliver effectively while

ensuring social distancing. One option may be the greater use of body scanning

technologies but making this a viable option financially in most retails stores

is highly unlikely.

So, it is likely that retailers will experience some loss head winds but also

some tail winds as well as they grapple with the challenges of operating in a

socially distancing environment. Understanding which of these countervailing

winds will dominate is hard to tell at this stage.

Phase 4: Post Pandemic Period

I have always been rather averse to future gazing, just ask the man who invented

the Betamax technology or the IBM executive who posited that the world would

only need 5 computers...! I have little doubt that retailing will gradually edge

its way back to pre-pandemic patterns of activity - the death of the high street

and the shopping mall has been a recurring theme for several decades.

Undoubtedly, there will be many retail casualties, with several well know names

disappearing for ever. But, I think we could see some possible lasting changes

as a consequence of the seismic impact of the Pandemic on the retail sector in

general and loss prevention in particular. Some of these could be the following.

•

Numerous Loss Prevention leaders have spoken about the benefits of becoming a

more agile and responsive business, prepared to take decisions quicker and with

less navel gazing and managerial deliberations. It may be that the COVID

enforced way of getting things done becomes the new norm.

•

The exclusion of many Loss Prevention team members from retail stores and the

need to work from home led to some developing a greater analytical desk-based

approach to their work - what does the available data reveal and how can it be actioned? This can only be a good thing; replacing travel time with analysis

time should lead to greater insights, improved productivity and more targeted

use of limited resources. Needless to say, thought will need to be given to how

staff will access a range of data sources remotely and securely.

•

Retailers may reflect positively upon the impact of exit and entrance controls

in some formats and decide they offer valuable control benefits, especially as

customers will have grown familiar with their presence. As yet, little if any

research has been undertaken to measure their impact although a number of UK

retailers were undertaking a 'target hardening' approach to some of their more

high-risk stores prior to the Pandemic.

•

Retailers may reflect positively upon the impact of exit and entrance controls

in some formats and decide they offer valuable control benefits, especially as

customers will have grown familiar with their presence. As yet, little if any

research has been undertaken to measure their impact although a number of UK

retailers were undertaking a 'target hardening' approach to some of their more

high-risk stores prior to the Pandemic.

•

Both E-commerce shopping and Self-scan use have grown considerably during the

Pandemic and it is likely that many COVID converts will continue to use them. I

have written elsewhere about the risks associated with

Self-scan - retailers will need to continue to invest in not only

technologies and store design to help manage this problem, but also in the

selection, training and incentivisation of staff responsible for their control.

This is a specialist role, requiring a unique skill set, and retailers will need

to continue to invest to ensure they keep self-scan related losses under

control. Equally, as we understand more about the losses associated with

E-commerce activities, not least the challenge of

managing returns, then this should become an increasing focus for loss

prevention teams.

•

Many retailers have commented upon the extent to which there has been much

greater collaboration and communication, not only between retail loss prevention

teams, but also with manufacturers and technology providers. Certainly times of

crisis tend to encourage a greater desire to work collectively to meet an

existential threat, but there does seem a genuine willingness to keep these

co-operative channels open - something which the

ECR Retail Loss

Group will of course be more than happy to foster!

Finally...

We are currently navigating through one of the most turbulent periods the retail

industry has ever faced - it is an often over used word, but unprecedented on

this occasion accurately reflects what we are witnessing. Given that, it is

clearly very difficult to know what is going to happen - history can only be a

partial guide on this one. It is therefore important that we do not jump to

conclusions too quickly about what has and is going to happen. Charting losses

in the retail sector is less than easy at the best of times and so we need to be

careful that any identifiable changes are a genuine reflection of reality rather

than as a consequence of the way in which practitioners go about measuring them.

We also need to avoid a culture of scaremongering as a means to somehow justify

the existence of the Loss Prevention Department - there will be plenty to do

without over-egging the proverbial pudding. Indeed, there is certainly a need

for Loss Prevention as a function to increasingly re-evaluate its raison d'être,

something which started well before the onset of the Pandemic, and something I

have elaborated on in my

Total Retail Loss work. Now might be as good a time as ever to begin this

reflection.

Perhaps it is appropriate to end with another apocryphal Chinese quote, this

time supposedly from Chairman Mao who possibly said: 'we live in interesting

times'; indeed we do.

I would be delighted to hear from you about your thoughts on any of the issues I

have covered in this short article, particularly things you think I have missed

or got wrong! Keep safe.

Read more here from Adrian Beck on 'Total Retail Loss'