NRF Reports Retail Shrink Nearly

a $100B Problem

2022 National Retail Security Survey released today

by the National Retail Federation

September 14, 2022 -- WASHINGTON - Retail shrink, when taken as a

percentage of total retail sales in 2021, accounted for $94.5 billion in

losses last year, up from $90.8 billion in 2020, according to the

2022 National Retail Security Survey released today by the National

Retail Federation. Organized retail crime (ORC), a critical component of that

shrink, is a growing challenge both for retailers and the industry at large.

"The factors contributing to retail shrink have multiplied in recent years, and

ORC is a burgeoning threat within the retail industry," NRF Vice

President for Research Development and Industry Analysis Mark Mathews said.

"These highly sophisticated criminal rings jeopardize employee and customer

safety and disrupt store operations. Retailers are bolstering security efforts

to counteract these increasingly dangerous and aggressive criminal activities."

The survey found that the average shrink rate in 2021 was 1.44%, a slight

decrease from the last two years but comparable to the five-year average of

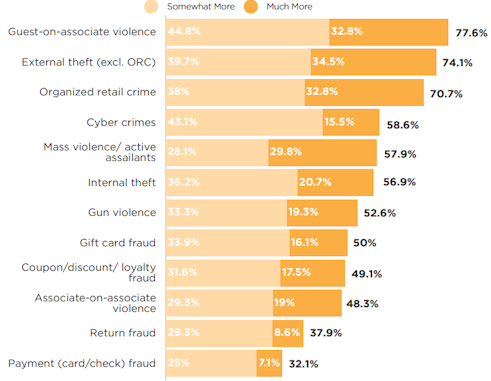

1.5%. The majority of retailers report that in-store, ecommerce and omnichannel

fraud have risen. Violence is a growing area of concern and retailers are

prioritizing addressing guest-on-associate violence, external theft and ORC.

Increase in Risk and Threat Priorities over

the Past Five Years

The COVID-19 pandemic created more challenges for retailers. A large majority (87.3%)

of respondents said the pandemic resulted in an increase in overall risk for

their organization. Retailers specifically cited an

increase in violence (89.3%), shoplifting (73.2%), ORC and employee theft

(tied at 71.4%) as a result of the pandemic.

Retailers reported a 26.5% increase in ORC, on average. Even more

alarming, the vast majority (81.2%) said the violence and aggression associated

with ORC increased in the past year.

Research shows that ORC groups commit retail crimes for their financial benefit,

and specifically target items that are concealable, removable, available,

valuable, enjoyable and disposable, also known by the acronym CRAVED. Items that

have more of these characteristics are more likely to be stolen. The top

categories targeted include apparel, health and beauty, electronics/appliances,

accessories, food and beverage, footwear, home furnishings and housewares, home

improvement, eyewear, office supplies, infant care and toys.

The top five cities/metropolitan areas affected by ORC in the past year were

Los Angeles, San Francisco/Oakland, New York, Houston and Miami.

Retailers are prioritizing new resources to safeguard their customers, employees

and operations, with nearly half (44.5%) indicating loss prevention as an

area of investment. More than half (60.3%) are increasing their technology

budget and 52.4% are increasing their capital and equipment budget. As part of

these efforts, many are investing in various technologies, including RFID,

computer vision at point of sale and license plate recognition.

"Reducing instances of violent crime, particularly those affiliated with ORC,

is a key priority among retailers because it directly and immediately impacts

employees in numerous capacities," Loss Prevention Research Council Senior

Research Scientist Cory Lowe said. "In many cases, it is difficult to measure

the full extent of these crimes without being investigated internally and in

coordination with law enforcement."

As retailers implement additional measures to diminish and ultimately prevent

ORC-related incidents from occurring, policy reform is still needed. A majority

of respondents (70.8%) reported an increase in ORC where felony thresholds

have increased. Retailers desire stronger ORC legislation, especially at the

federal level, as well as better enforcement of existing laws.

The 2022 National Retail Security Survey was conducted online among senior loss

prevention and security executives in the retail industry. The study was done in

partnership with the Loss Prevention Research Council and is sponsored by

Appriss Retail.

Click

here to view the report.

About NRF

The

National Retail Federation, the world's largest retail trade association,

passionately advocates for the people, brands, policies and ideas that help

retail thrive. From its headquarters in Washington, D.C., NRF empowers the

industry that powers the economy. Retail is the nation's largest private-sector

employer, contributing $3.9 trillion to annual GDP and supporting one in four

U.S. jobs - 52 million working Americans. For over a century, NRF has been a

voice for every retailer and every retail job, educating, inspiring and

communicating the powerful impact retail has on local communities and global

economies. nrf.com

The

National Retail Federation, the world's largest retail trade association,

passionately advocates for the people, brands, policies and ideas that help

retail thrive. From its headquarters in Washington, D.C., NRF empowers the

industry that powers the economy. Retail is the nation's largest private-sector

employer, contributing $3.9 trillion to annual GDP and supporting one in four

U.S. jobs - 52 million working Americans. For over a century, NRF has been a

voice for every retailer and every retail job, educating, inspiring and

communicating the powerful impact retail has on local communities and global

economies. nrf.com

About the LPRC

The

Loss Prevention Research

Council was founded in 2000 by leading retailers and Dr. Read Hayes, an NRSS

co-founder, in an effort to support the evidence-based needs of loss prevention

decision-makers. To date, the LPRC has conducted over 300 studies with retailers

and other research partners. The LPRC strives to provide comprehensive research,

development opportunities, and collaborative spaces for our members that will

enable the innovation of retail loss and crime control solutions.

The

Loss Prevention Research

Council was founded in 2000 by leading retailers and Dr. Read Hayes, an NRSS

co-founder, in an effort to support the evidence-based needs of loss prevention

decision-makers. To date, the LPRC has conducted over 300 studies with retailers

and other research partners. The LPRC strives to provide comprehensive research,

development opportunities, and collaborative spaces for our members that will

enable the innovation of retail loss and crime control solutions.

&uuid=(email))