Click here to view the web version of this report

The D&D Daily's Publicly Reported

& Industry's Only

Q4 & 2020 Organized Retail Crime Report

COVID Drives ORC Cases & Suspects

Down - But Dollar Amount Spikes

ORC Cases Down 24%

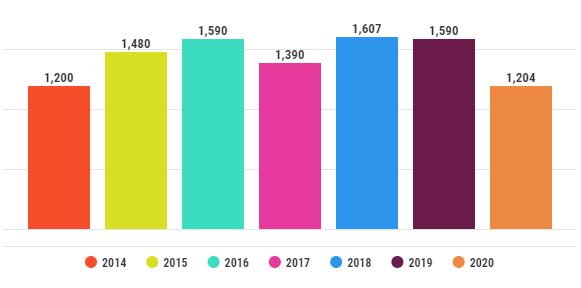

in 2020 - Lowest Since 2014

Dollar Amount

Highest Ever Recorded - Up 71% Since '19

Yearly

ORC Case Comparison - Down 24% From '19

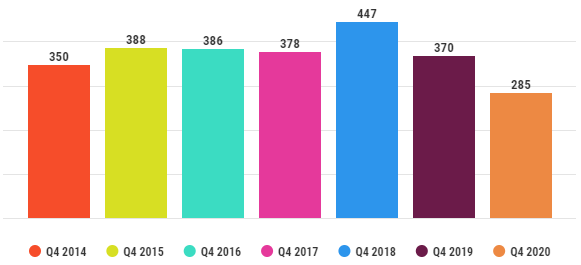

Q4 ORC Case Comparison - Down 23% From '19

| Year | $ Amount Reported | $ Average Per Case |

| 2014 | $681,802,614 | $194,002 |

| 2015 | $515,088,741 | $112,222 |

| 2016 | $514,285,830 | $71,877 |

| 2017 | $389,445,396 | $97,658 |

| 2018 | $165,493,452 | $102,982 |

| 2019 | $248,763,877 | $141,360 |

| 2020 | $291,495,187 | $242,106 |

•

Average case value up 71% since 2019 - highest recorded over 7 years

•

Average case values: Ranged from

a low of $71,877 to a high of $242,106.

•

2016 to present represents post-EMV

Special note: 2014 and 2015 amounts reflect the pre-EMV roll-out and a

larger amount of big counterfeit credit card cases.

The following high-dollar counterfeit credit card cases were excluded in the

average calculations:

•

Two $200M cc fraud cases on

May 14 &

June 20, 2014

•

One $325M counterfeit case on

Jan. 16, 2015

•

Two $200M cc fraud cases on

Jan. 8 &

May 9, 2016

•

One $170M cc fraud case on

April 19, 2017

•

One $51M cc fraud case on

May 23, 2018

• One $30M cc fraud case

on

Sept. 26, 2014

• One $24M cc/gift card fraud case

on

July 11, 2019

|

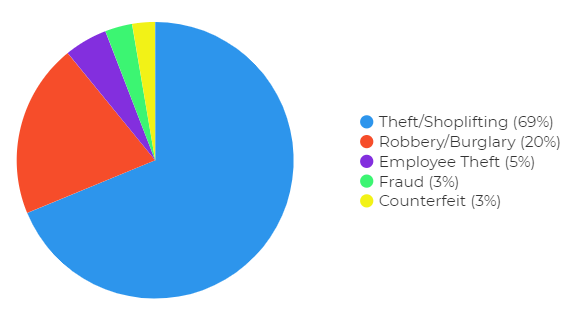

2020 ORC Cases by Type  |

|

2020 Cases: 1. Theft/Shoplift - 69% 2. Robbery/Burg. - 20% 3. Emp. Theft - 5% |

2019 Cases: 1. Theft/Shoplift - 70.5% 2. Robbery/Burg. - 13.5% 3. Emp. Theft - 6% |

2018

Cases: 1. Theft/Shoplift - 66% 2. Robbery/Burg. - 12% 3. Emp. Theft - 8% |

|

2017

Cases: 1. Theft/Shoplift - 67% 2. Robbery/Burg. - 11% 3. Emp. Theft - 6% |

2016

Cases: 1. Theft/Shoplift - 67% 2. Other - 11% 3. CC Fraud - 8% |

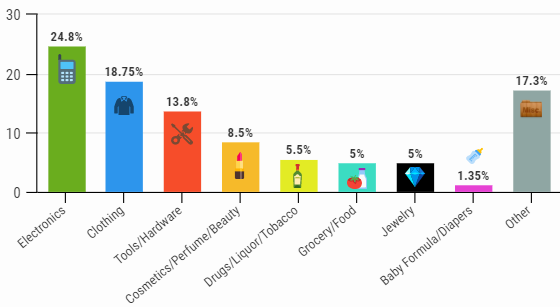

2020 ORC Cases by Merchandise Stolen

|

2020 • Electronics (24.8%) • Clothing (18.75%) • Tools (13.8%) |

2019 • Clothing (23%) • Electronics (22%) • Tools (12%) |

2018 1. Clothing (30%) 2. Electronics (27%) 3. Tools (14%) |

2017* 1. Electronics (30%) 2. Clothing (16%) 3. Jewelry (15%) |

*Quarterly breakdown not available for 2017 **Other includes Sporting Goods, Housewares, Gift cards, Specialty |

|||

2020 ORC Suspect Comparison

| Year | Suspects | Male | Female | Unreported | % Male | % Female |

| 2014 | 3,235 | 1,764 | 1,048 | 423 | 63% | 37% |

| 2015 | 3,528 | 1,843 | 1,097 | 588 | 63% | 37% |

| 2016 | 3,682 | 1,687 | 1,006 | 989 | 63% | 37% |

| 2017 | 3,225 | 1,319 | 901 | 1,005 | 59% | 41% |

| 2018 | 3,420 | 1,701 | 1,142 | 577 | 60% | 40% |

| 2019 | 3,710 | 2,018 | 1,188 | 504 | 63% | 37% |

| 2020 | 2,810 | 1,895 | 906 | 9 | 68% | 32% |

Fewest suspects recorded in publicly reported data.

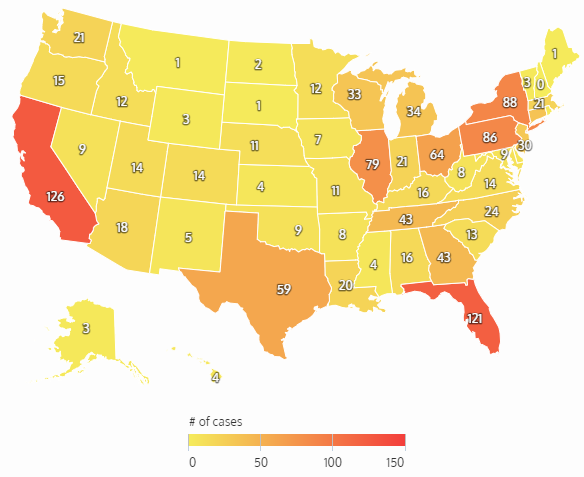

2020 ORC Cases by State & City

|

Top States - 2020 1. California (126) 2. Florida (121) 3. New York (88) 4. Pennsylvania (86) 5. Illinois (79) |

Top States - 2019 1. California (189) 2. Florida (145) 3. Pennsylvania (109) 4. Texas (91) 5. Illinois (90) |

|

Top States - 2018 1. California (161) 2. Florida (142) 3. Pennsylvania (116) 4. Illinois (100) 5. Texas (78) |

Top States - 2017 1. California (88) 2. Florida (82) 3. Pennsylvania (68) 4. Texas (59) 5. Illinois (54) |

|

|

|

|

Top Cities - 2020 • New York City (24) • Chicago, IL (10) • Coral Springs, FL (9) • Jacksonville, FL & Madison, WI (8) • Lexington, KY & Miami, FL (7) |

Top Cities - 2019 • Millburn, NJ (20) • Chicago, IL (17) • Laredo, TX (12) • Houston, TX (11) • Miami, FL & Fresno, CA (10) |

|

Top

Cities - 2018 1. Memphis, TN & Tallahassee, FL (14) 2. Detroit, MI & Oklahoma City, OK (13) 3. Houston, TX (12) 4. Chicago, IL (10) 5. Lexington, KY & Albuquerque, NM (9) |

Top

Cities - 2017* 1. Houston, TX & Milburn, NJ (9) 2. Memphis, TN & Columbus, OH (8) 3. Louisville, KY & Lexington, KY (7) 4. Polk County, FL (6) 5. Oklahoma City, OK (6) |

![]() Share on Facebook

Share on Facebook

![]() Share on Twitter

Share on Twitter

![]() Share on LinkedIn

Share on LinkedIn

|

|

Reporting Methodology:

The D&D Daily gathers retail-store specific information from public news media

sources throughout the United States and reports it daily through our

industry-renowned e-newsletter. We do not survey any retailers or third parties

nor collect information from any retail executives. All of this information is

available through public news media outlets. We do not claim nor does it

represent all such incidents or deaths that may occur in retail locations or

retail corporate facilities, as many may not be reported in the news media

depending on a number of variables outside of our control. We are not

responsible for the accuracy of the information reported in the various news

media outlets. We do not name any retailer, retail executive, suspect, or

victim.

Reposting/Sharing:

Portions of this report

or its findings may be reposted or shared with proper attribution to the D&D

Daily and a link back to this report page where possible.

Email our team to let us

know!

About The D&D Daily:

The D&D Daily is the #1

daily digital news source for the retail industry focused on retail trends, Loss

Prevention, Asset Protection and Cyber Security. Established in 2010, this

free daily e-newsletter is designed to deliver the information, news,

trends, retail crime data, technology developments, executive movement, and jobs

every day. Using a 2-minute drill type format, this '#1 copy-paste tool' allows

retail executives to see what’s important, relevant and critical, share it

throughout the organization quickly and easily, while saving the executives time

and providing them with the information they need to reduce shrink, increase

profitability and help make America’s retail stores safe. Visit

www.D-Ddaily.net and

sign up for your free email.

&uuid=(email))