Click here to view the web version of this report

The D&D Daily's Publicly Reported

Q1 2020 ORC Report

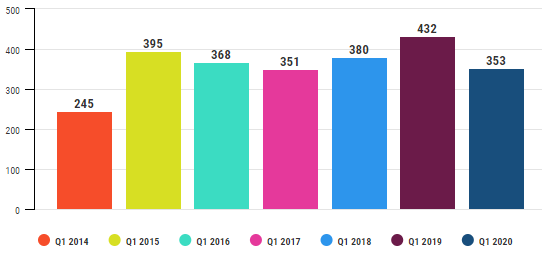

ORC Cases Drop 18% Since Q1 2019 - Up 44% Since '14

Average Dollar Amount Up 86% Since Q1 2019

Q1 ORC Case Comparison

Down 18% Since '19 - Up 44% Since '14

| Q1 | $ Amount Reported | $ Average Per Case |

| 2014 | $116,392,986 | $152,624 |

| 2015 | $380,464,168 | $140,415 |

| 2016 | $208,051,138 | $21,878 |

| 2017 | $32,912,889 | $93,768 |

| 2018 | $32,829,145 | $86,392 |

| 2019 | $23,655,937 | $54,759 |

| 2020 | $36,027,712 | $102,061 |

• 366%

increase since 2016 - 86% increase since 2019

•

Average Case Values: Ranged from a low of $21,878 to a high of $152,624.

•

2016 to present represents post-EMV

Special note: 2014 and 2015 amounts reflect the pre-EMV roll-out and a

larger amount of big counterfeit credit card cases.

The following high-dollar counterfeit credit card cases were excluded in

the average calculations:

•

One $325M counterfeit case on

Jan. 16, 2015

•

One $200M cc fraud cases on

Jan. 8, 2016

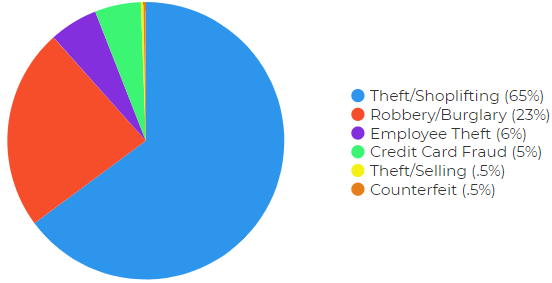

Q1

ORC Cases By Type

Theft/Shoplifting Top Method Five Years Running

|

Q1 ORC Cases by Merchandise Stolen

Electronics & Clothing Most Targeted

Four Years Running

|

Q1

'20

Top Merchandise: 1. Electronics - 28% 2. Clothing - 21% 3. Tools - 13% |

Q1 '19

Top Merchandise: 1. Electronics - 23% 2. Clothing - 21% 3. Tools - 12% |

Q1 '18

Top Merchandise: 1. Electronics - 33% 2. Clothing - 23% 3. Tools - 15% |

*2017 Top Merchandise: 1. Electronics - 30% 2. Clothing - 16% 3. Jewelry - 15% |

|

|

|||

Q1 ORC Suspect Comparison

| Q1 | Suspects | Male | Female | Unreported | % Male | % Female |

| 2014 | 649 | 408 | 241 | 0 | 63% | 37% |

| 2015 | 894 | 480 | 298 | 116 | 62% | 38% |

| 2016 | 762 | 423 | 250 | 89 | 63% | 37% |

| 2017 | 732 | 337 | 201 | 194 | 63% | 37% |

| 2018 | 826 | 463 | 280 | 83 | 62% | 38% |

| 2019 | 776 | 389 | 254 | 133 | 60% | 40% |

| 2020 | 734 | 492 | 233 | 9 | 68% | 32% |

Q1 ORC Cases by State

California & Florida Top 2 States

in Q1 2020

|

Top States in Q1

2020 |

Top States in Q1 2019 |

Top States in Q1 2018 |

|

Top States in

Q1 2017 |

Top States in Q1 2016 |

|

![]() Share on Facebook

Share on Facebook

![]() Share on Twitter

Share on Twitter

![]() Share on LinkedIn

Share on LinkedIn

|

|

Methodology: The Daily

collects this retail store specific information from public news media

sources throughout the United States and reports it daily in our Organized

Retail Crime column. We do not survey any retailers or third parties nor collect

information from any retail executive. All of this information is available

through public news media outlets. We do not claim nor does it represent all

such incidents or deaths that may occur in retail locations or retail

corporate facilities as many may not be reported in the news media depending

on a number of variables outside of our control. We are not responsible for

the accuracy of the information reported in the various news media outlets.

We do not name any retailer, retail executive, suspect, or victim.

Copyright: We reserve the rights to this industry exclusive

report and do not authorize its republication or reproduction without

written consent which may include a fee. By re-publishing or reproducing

this report or any parts of it without authorization the party agrees to pay

a fee determined by the D&D Daily.

Auror

Sponsor of the D&D

Daily’s ORC News Column

Thanks, Auror, for making this

column and this report possible.

Hey LP and AP Execs - Thank Auror!

&uuid=(email))