Click here to view the web version of this report

The D&D Daily's

Exclusive - Publicly Reported

Q4 & 2019 ORC Report

ORC Cases Up 33% Over 5 Years - Flat Since 2018

Average Dollar Amount Doubled Since '16 - Up 37% Since '18

Most Suspects Ever Recorded - Male or Female

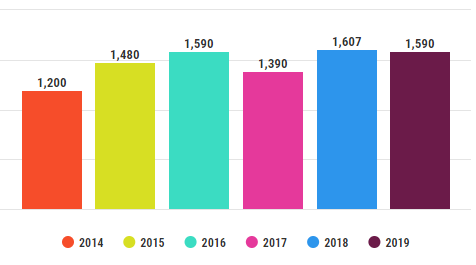

Yearly ORC Case Comparison - Down 1% Over '18

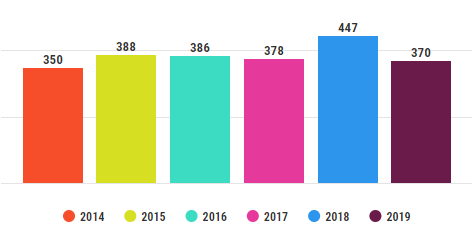

Q4 ORC Case Comparison - Down 17% Over '18

Latest

NRF ORC Study Highlights Similar Trends

Latest

NRF ORC Study Highlights Similar Trends

Two-Thirds of Retailers See Increase in Organized Thefts

"Organized

retail crime continues to present a serious challenge to the retail

industry," NRF Vice President of Loss Prevention Bob Moraca said.

The report found that

97 percent of retailers had been victimized by ORC in the past year and

that 68 percent had seen an increase in ORC activity.

Losses averaged $703,320 per $1 billion in sales, marking the fourth

year in a row that the figure topped the $700,000 mark.

Nearly two-thirds (65 percent) of retailers said ORC is a higher

priority for their companies than five years ago,

while 56 percent were allocating additional technology resources to the

issue and 44 percent were increasing their loss prevention budgets.

The top five cities for ORC in the past year in order were Los Angeles,

New York, Houston, Chicago and Miami,

with a number of ties rounding out the top 10.

nrf.com

| Year | # of Cases | $ Amount Reported | $ Average Per Case |

| 2014 | 1,200 | $681,802,614 | $194,002 |

| 2015 | 1,480 | $515,088,741 | $112,222 |

| 2016 | 1,590 | $514,285,830 | $71,877 |

| 2017 | 1,390 | $389,445,396 | $97,658 |

| 2018 | 1,607 | $165,493,452 | $102,982 |

| 2019 | 1,590 | $248,763,877 | $141,360 |

• Average

case value nearly doubled since 2016, 37% increase since 2018

•

Average case values: Ranged from a low of $71,877 to a high of $194,002.

•

2016 to present represents post-EMV

Special note: 2014 and 2015 amounts reflect the pre-EMV roll-out and a

larger amount of big counterfeit credit card cases.

The following high-dollar counterfeit credit card cases were excluded in the

average calculations:

•

Two $200M cc fraud cases on

May 14 &

June 20, 2014

•

One $325M counterfeit case on

Jan. 16, 2015

•

Two $200M cc fraud cases on

Jan. 8 &

May 9, 2016

•

One $170M cc fraud case on

April 19, 2017

•

One $51M cc fraud case on

May 23, 2018

• One $30M cc fraud case

on

Sept. 26, 2014

• One $24M cc/gift card fraud case

on

July 11, 2019

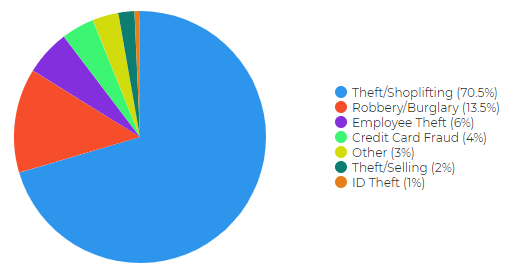

ORC Cases By Type

|

|

2019 Cases: 1. Theft/Shoplift - 70.5% 2. Robbery/Burg. - 13.5% 3. Emp. Theft - 6% |

2018

Cases: 1. Theft/Shoplift - 66% 2. Robbery/Burg. - 12% 3. Emp. Theft - 8% |

2017

Cases: 1. Theft/Shoplift - 67% 2. Robbery/Burg. - 11% 3. Emp. Theft - 6% |

2016

Cases: 1. Theft/Shoplift - 67% 2. Other - 11% 3. CC Fraud - 8% |

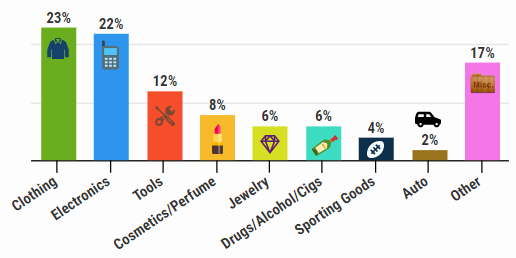

ORC Cases by Merchandise Stolen

|

2019 • Clothing (23%) • Electronics (22%) • Tools (12%) |

2018 1. Clothing (30%) 2. Electronics (27%) 3. Tools (14%) |

2017* 1. Electronics (30%) 2. Clothing (16%) 3. Jewelry (15%) |

*The Daily started tracking merchandise in May 2017 **Other includes eyewear, baby formula/diapers, detergent, groceries, gift cards, lottery, gas, hobby, coins, cash, razors & n/a |

||

ORC Suspect Comparison

| Year | Suspects | Male | Female | Unreported | % Male | % Female |

| 2014 | 3,235 | 1,764 | 1,048 | 423 | 63% | 37% |

| 2015 | 3,528 | 1,843 | 1,097 | 588 | 63% | 37% |

| 2016 | 3,682 | 1,687 | 1,006 | 989 | 63% | 37% |

| 2017 | 3,225 | 1,319 | 901 | 1,005 | 59% | 41% |

| 2018 | 3,420 | 1,701 | 1,142 | 577 | 60% | 40% |

| 2019 | 3,710 | 2,018 | 1,188 | 504 | 63% | 37% |

Most suspects - male or female - ever recorded in publicly reported data.

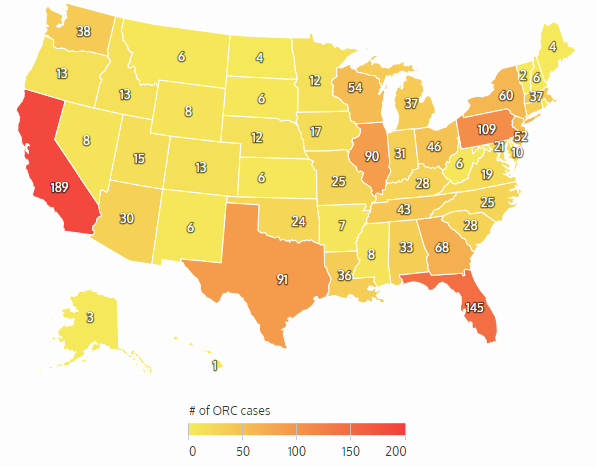

ORC Cases by State & City

|

Top States - 2019 |

Top States - 2018 |

Top States - 2017 |

Top States - 2016 |

|

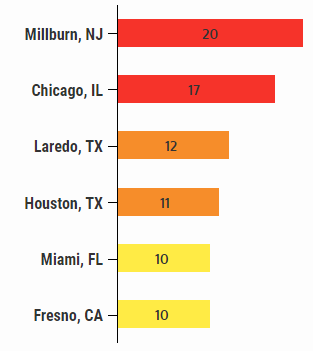

Top Cities - 2019 • Millburn, NJ (20) • Chicago, IL (17) • Laredo, TX (12) • Houston, TX (11) • Miami, FL & Fresno, CA (10) Top Cities - 2018 1. Memphis, TN & Tallahassee, FL (14) 2. Detroit, MI & Oklahoma City, OK (13) 3. Houston, TX (12) 4. Chicago, IL (10) 5. Lexington, KY & Albuquerque, NM (9) Top Cities - 2017* 1. Houston, TX & Milburn, NJ (9) 2. Memphis, TN & Columbus, OH (8) 3. Louisville, KY & Lexington, KY (7) 4. Polk County, FL (6) 5. Oklahoma City, OK (6) |

|

*The Daily started tracking city data in May 2017 |

|

![]() Share on Facebook

Share on Facebook

![]() Share on Twitter

Share on Twitter

![]() Share on LinkedIn

Share on LinkedIn

|

|

Methodology: The Daily

collects this retail store specific information from public news media

sources throughout the United States and reports it daily in our Organized

Retail Crime column. We do not survey any retailers or third parties nor collect

information from any retail executive. All of this information is available

through public news media outlets. We do not claim nor does it represent all

such incidents or deaths that may occur in retail locations or retail

corporate facilities as many may not be reported in the news media depending

on a number of variables outside of our control. We are not responsible for

the acccuracy of the information reported in the various news media outlets.

We do not name any retailer, retail executive, suspect, or victim.

Copyright: We reserve the rights to this industry exclusive

report and do not authorize its republication or reproduction without

written consent which may include a fee. By re-publishing or reproducing

this report or any parts of it without authorization the party agrees to pay

a fee determined by the D&D Daily.