|

|

|

&uuid=(email)) |

|

&uuid=(email))  |

|

|

The Rise of Pandemic-Driven Retail Fraud:

How Brands Are Leveraging Prescriptive Analytics to Fight Back

By Guy Yehiav, Vice President & General

Manager, Zebra Analytics

With

margins already tightened by the financial impact of the COVID-19 pandemic, the

oft-undetected but constant siphon of funds caused by fraud is devastating for

retailers. A

recent study revealed the cost of fraud to U.S. retailers and e-commerce

companies rose 7 percent in 2020, with every $1 of fraud costing companies $3.36

in losses. With

margins already tightened by the financial impact of the COVID-19 pandemic, the

oft-undetected but constant siphon of funds caused by fraud is devastating for

retailers. A

recent study revealed the cost of fraud to U.S. retailers and e-commerce

companies rose 7 percent in 2020, with every $1 of fraud costing companies $3.36

in losses.

By leveraging prescriptive analytics, retailers are relying on powerful

data-driven software to identify instances of fraud and noncompliance, recommend

corrective action, and prevent it from happening again both in stores and

online.

Minimizing Brick-and-Mortar Fraud

To create a safe and healthy in-store shopping experience during the pandemic,

many retailers updated their operations and processes to include social

distancing measures. They enhanced self-checkout offerings, which minimized

employee presence on the floor. While these measures were critical to supporting

community health, they have unfortunately opened the door to fraud committed by

employees and customers alike

Continue Reading

Maverik Selects Zebra and Reflexis to Streamline Store Execution and Labor

Scheduling

Reflexis

Systems (now part of

Zebra Technologies), a leading provider of intelligent workforce management

and execution solutions for multi-site businesses in retail, food service,

hospitality and banking, today announced that Maverik — Adventure’s First Stop,

has selected

Reflexis ONE to integrate and streamline store execution and labor

scheduling for more than 6,000 team members across 360+ locations. Reflexis

Systems (now part of

Zebra Technologies), a leading provider of intelligent workforce management

and execution solutions for multi-site businesses in retail, food service,

hospitality and banking, today announced that Maverik — Adventure’s First Stop,

has selected

Reflexis ONE to integrate and streamline store execution and labor

scheduling for more than 6,000 team members across 360+ locations.

Continue Reading

Violence & Protests

Summer 2021: "Going to be worse than last year, for sure."

Police in Cities Across U.S. Brace for a Violent Summer

Lifting of Covid restrictions, rise in gun purchases

have officials on edge heading into warmer months

Crime experts fear summer 2021 violence could be worse than last year as

shooting,

murder uptick starts early

369 people were shot in the past 72 hours as

of Friday afternoon, the Gun Violence Archive says

Police

departments in New York City and other large metro areas across the U.S. are

bulking up patrols and implementing new tactics to prepare for what they say

could be a violent summer. Police

departments in New York City and other large metro areas across the U.S. are

bulking up patrols and implementing new tactics to prepare for what they say

could be a violent summer.

Police should brace for a potentially more violent summer than last year as

crime trends show the bloodshed in some parts of the country, such as New York

City, picked up earlier than is typically expected, analysts and experts

say.

States lifting Covid-19 restrictions and more people out in public spaces in

warmer weather increase the likelihood of more shootings, as well as

less-serious crimes, officials say. Many crimes, including violent ones,

normally rise in summer. Gun purchases also rose during the pandemic and cities

have seen an increase in guns being used in crimes.

Shootings and homicides in big U.S. cities

are up this year again after rising last year. In the last three months

of 2020, homicides rose 32.2% in cities with a population of at least one

million.

"It's not getting any better," Joseph Giacalone, an adjunct professor with the

John Jay College of Criminal Justice, told Fox News. "Let's put it this way: New

York City is already ahead of last year's pace, but last year, the homicides and

shootings

really started spiking at the end of May and into June. So that will be the real

tale of the tape, so to speak, to see what's happening over there."

"So, if you look at New York, Chicago, St. Louis,

Baltimore, you name the big cities and they're having huge problems,"

Giacalone added. The fast-approaching summer months generally bring out "more

crime because there are more people out there."

Continue Reading

Fed's Partner, Expand & Fund Gun Violence Initiatives in Baltimore

Increasing prosecution of gun related crimes in

Baltimore

U.S. Attorney’s Office and State and Local Partners Announce Expansion of

Firearms Prosecution Initiative Targeting Gun Violence in Baltimore

Also Announced Funding for Community Outreach and Intervention Efforts;

Increased State Funding to Hire Additional Prosecutors Builds on 84 Federal Gun

Possession Cases Charged in Baltimore Since January 2020 – Despite Pandemic

Baltimore, Maryland – Today, Acting United States Attorney for the

District of Maryland Jonathan F. Lenzner announced a significant expansion of

the U.S. Attorney’s Office’s collaborative initiative with state and local

law enforcement to prosecute the illegal possession of firearms in Baltimore.

The expansion of the initiative, known as Project EXILE, includes state

funding to hire additional prosecutors to bring firearms-related offenses in

federal court and for a media campaign supporting outreach efforts into

Baltimore neighborhoods.

justice.gov

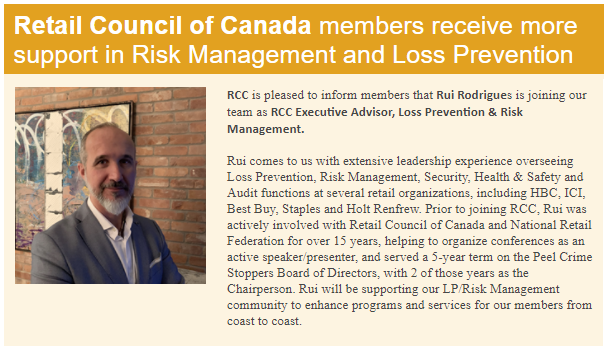

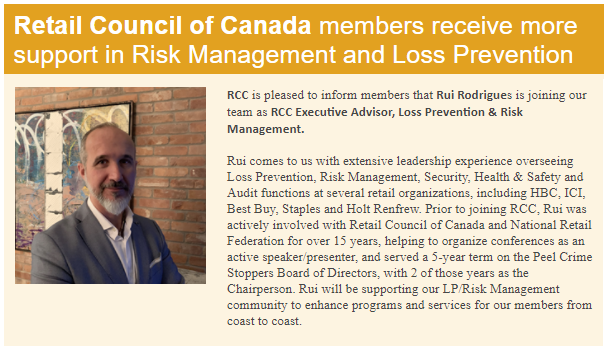

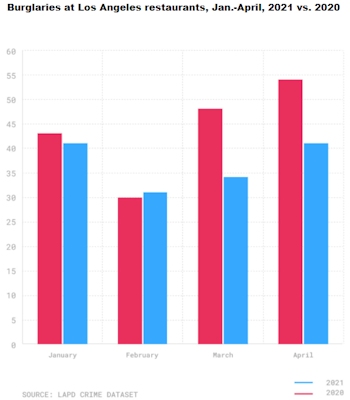

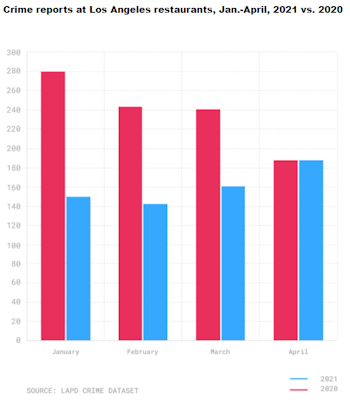

Burglaries Never Stopped During Shutdown

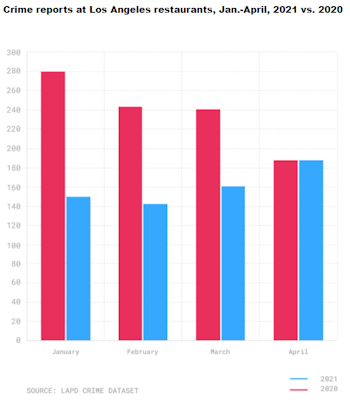

LA Restaurant Crime Up 32% Between February & April

Los Angeles Restaurants Already Seeing Crime Spike Even Before Scheduled June

15th Full Opening

Some operators have already seen an unwanted sign of people leaving their

homes: burglary, vandalism and other crimes.

There were 187 crimes at restaurants reported to police in April, up from 160

in March and 142 in February,

according to Los Angeles Police Department data.

Overall crime in Los Angeles from Jan. 1-April 30 this year is 5.5% below the

same period in 2020.

Lilly Rocha, executive director of the

Latino

Restaurant Association, was surprised to learn about the increase in crime,

but was aware of many restaurants being targeted for “dine and dash” schemes.

According to police data, bodily force was used in 17% of restaurant crimes

reported from Feb. 1-April 30 (the period when incidents began rising). There

were 61 instances of assault and vandalism.

In particular, burglaries at restaurants have been increasing, going from

31 incidents in February to 41 in April. Burglaries accounted for 20% of all

crime reported at Los Angeles restaurants from Feb. 1-April 30.

Burglaries never stopped in LA during shutdown.

Although most restaurants in Los Angeles were forced to halt in-person service

for much of 2020, burglaries never ceased, perhaps reflecting

opportunistic thieves who took advantage of the lack of customers. In

January 2020 there were 43 restaurant burglaries, followed by 30 the next month

and 48 in March. There were 49 burglaries in April, the first full month of

the shutdown, and at least 34 every month during the rest of the year.

xtown.la

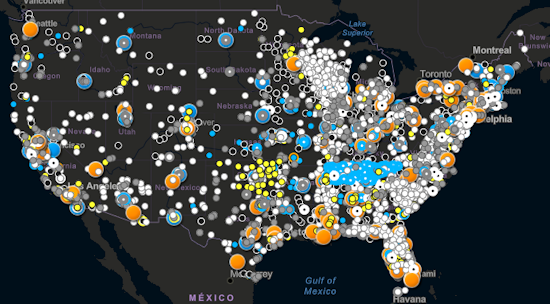

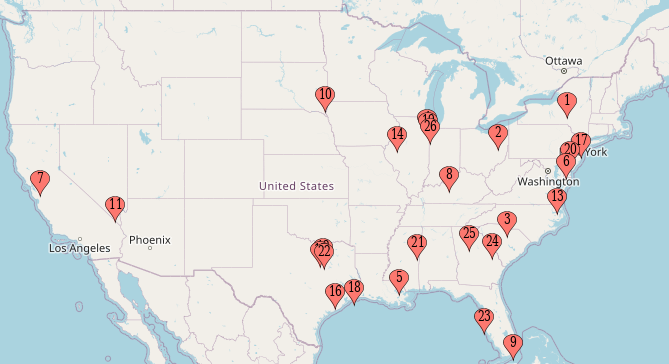

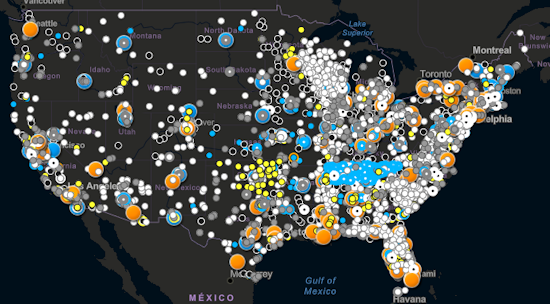

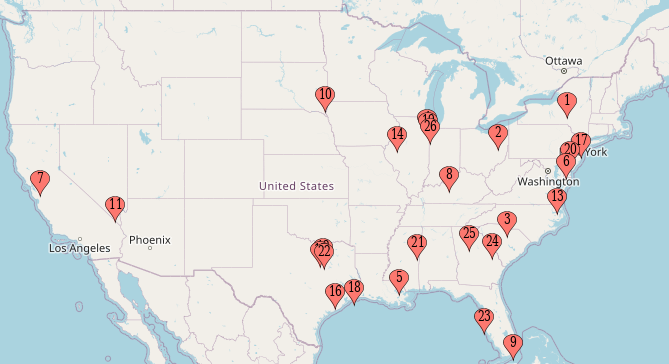

The Atlas of Surveillance

Really cool interactive map! Check it out

The Electronic Frontier Foundation Interactive Map of Police Tech in the U.S.

From law enforcement fusion centers to drone usage, body-worn cameras, license

plate readers, Ring Neighbors Partnership, Gunshot Detection, Predictive

Policing, Real-Time Crime Center, Cell-Site Simulator, Camera Registry, Face

Recognition, and Video Analytics this interactive map shows who's using the

technology.

With researchers combing locals and keeping this map up to date. Check it out.

Remember must be online to connect to the interactive version.

atlasofsurveillance.org

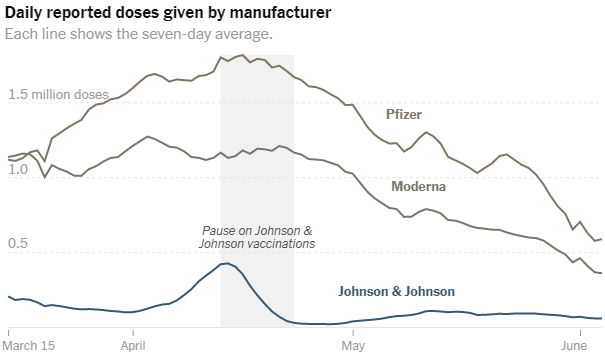

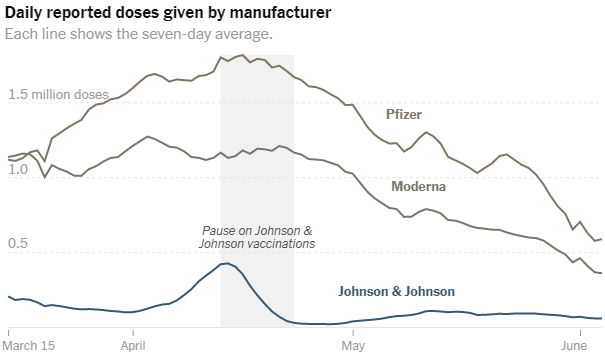

COVID Update

301.6M Vaccinations Given

US: 34.2M Cases - 612.3K Dead - 28.1M Recovered

Worldwide:

174M Cases - 3.7M Dead - 157.1M Recovered

Former Senior Loss Prevention Executive

Know of any fallen LP exec? Let's remember &

recognize.

Private Industry Security Guard Deaths: 279

Law

Enforcement Officer Deaths: 305

*Red indicates change in total deaths

U.S. Covid-19 Deaths Fall to Lowest Point Since March 2020

As vaccinations rise, the seven-day average of reported deaths has dropped

below 500

“This milestone reinforces that the U.S. is in the homestretch of the epidemic,

thanks to vaccinations,” said Andrew Brouwer, an assistant research scientist in

epidemiology at the University of Michigan.

The high rates of vaccinations among elderly people, who are most likely to die

from Covid-19 infections,

have helped push the number of deaths lower. And the steady decline in newly

reported cases indicates that deaths, a lagging indicator, will continue to

shrink.

wsj.com

Fry's Foods, Kroger Division, HR Mgr -

Fraudulent COVID Testing Invoices & Ghost Employee Payroll

Human Resources Manager Pleads Guilty to Defrauding Employer Through Payroll and

COVID-19 Testing Schemes

BOISE – Douglas Wold, 48, of Meridian, pleaded guilty to one count of wire

fraud, one count of mail fraud, and one count of money laundering based on

schemes to defraud his employer, Fry Foods, Inc., during the height of the

COVID-19 pandemic.

According to court records, Wold worked as a Human Resources Manager for Fry

Foods, Inc. in Ontario, Oregon, and executed two separate schemes.

First, beginning in at least May 2020 and continuing through August 2020, Wold

committed wire fraud by submitting fraudulent payroll requests for

individuals who never worked at Fry Foods or who no longer worked at Fry

Foods at the time of the payroll requests. Payroll checks were processed based

on Wold’s requests. Wold then deposited these fraudulent payroll checks into his

own bank accounts.

Second, Wold committed mail fraud with respect to a COVID-19 testing program at

Fry Foods’ Weiser, Idaho location in May 2020. Wold issued a fraudulent

invoice to Fry Foods in the name of his business, Hala Lallo Health, for $39,995

when, in fact, the testing was provided by another entity and at a greatly lower

cost. When Fry Foods paid Hala Lallo Health for the testing, Wold deposited

the funds into a bank account he controlled and the company that actually

provided the testing was not paid.

Wold committed the offense of engaging in monetary transactions in property

derived from unlawful activity by transferring $69,116.48 in proceeds from

his frauds for the purchase a speedboat and trailer.

Wire fraud and mail fraud carry a penalty of up to 20 years in federal

prison, a maximum fine of $250,000, and up to three years of supervised

release. Money laundering carries a penalty of up to ten years in federal

prison, a maximum fine of $250,000, and up to three years of supervised

release.

justice.gov

CFOs' essential role in promoting employee mental health

For professional accountants, mental health issues heighten the risk of not

identifying errors in financial reports or spotting indicators of fraud.

The coronavirus pandemic has put a long-overdue spotlight on mental health.

Clinical studies have found a

strong correlation between pandemic-related anxiety and behaviors, such as

hopelessness or substance abuse, that companies cannot afford to ignore.

Implementing an organizational framework to support mental health is not only

the right thing to do, it's smart for business. With the potential to alleviate

human and financial costs, support for mental health should be seen as core to

the finance function’s role in promoting sustainable value creation.

In 2019, the World Health Organization estimated that mental health issues

cost the global economy upward of

$1 trillion per year. In the wake of the past year, that cost is likely

to increase considerably, reinforcing the need for mental health to be a key

priority for employers and organizations worldwide.

cfodive.com

UK Retailers Not Paying Rent During Lockdown

2/3 of retailers face legal action once the moratorium ends in July over £2.9bn

in unpaid rents

With non-essential retailers closed due to lockdowns for eight of the last 15

months, many have accrued huge debts that they are only just beginning to be

able to pay. For the first quarter of the year showed that one in seven shops

currently lie empty, and this number is expected to rise.

The BRC said that without action, and where agreement between landlords and

retailers cannot be reached by July 1, thousands of shops will be at risk of

shutting down.

“Without action, it will be our city centres, our high streets and our shopping

centres that suffer the consequences, holding back the wider economic recovery.”

retailgazette.co.uk

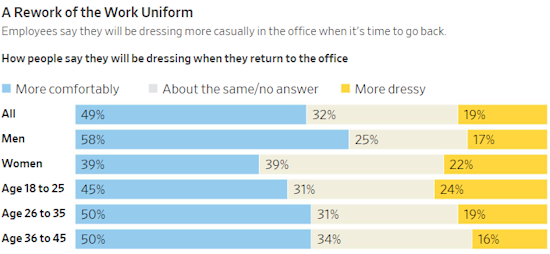

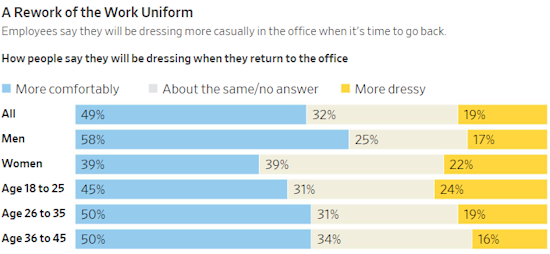

'Hybrid Dressing'

You’re Finally Going Back to the Office. What Are You Going to Wear?

The rules about what to wear to the office are gone. Now retailers, workers and

employers are trying to figure out what will work in a world in which the

traditional dress code might never come back.

After more than a year of working from home, millions of Americans are heading

back to the office—and they need new clothes. That offers a rare opportunity to

retailers, who are trying to anticipate what their customers will now want to

wear to work. Many brands are scaling back their production of suits, adding

more stretch to their pants and using new phrases such as “workleisure.”

They are turning out yoga pants that look like dress pants, T-shirts you can

wear to work and a dressier version of cork-lined sandals dubbed the “Work Birk.”

‘No one is tucking in their shirts’:

wsj.com

Dallas City Council Cracks Down on C-Store

Crime With New Ordinances

Here’s how Dallas convenience stores must beef up security to deter crime

An extra camera and lighting are some of the changes now required by the

city.

All Dallas convenience stores are now required to have more surveillance

cameras, working outside lights and ATMs bolted to the floor.

The changes are part of new

city code to address neighborhood businesses linked to crimes and

quality-of-life concerns.

The new rules approved by the Dallas City Council on Wednesday will allow the

code enforcement department to take over most convenience store inspections from

the Police Department. The change is meant to free up officers to only focus

on stores that draw the most crime and resident complaints. It’s also to

increase the frequency of inspections and tracking of convenience stores.

A sharper focus on convenience stores in the city that drive criminal activity

is part of Dallas police Chief Eddie García’s

recently unveiled plan to try to decrease

violent crime.

Increased outdoor lighting also has been

previously identified by Mayor Eric Johnson’s task force on safe communities

as a possible crime deterrent. The city has since launched an initiative to

improve streetlights in certain areas.

Johnson in March said city data

showed crime and 911 calls were down this year in the area surrounding

South Dallas’ Opportunity Park after more than 70 new lights were installed two

months earlier.

Before Wednesday, the city required convenience stores to install at least two

color, high-resolution surveillance cameras, one with a clear view of the cash

register and the other where the faces of everyone who enters are visible.

The new requirements would call for at least a third camera that clearly

captures the faces of people leaving the store.

The cameras would be required to have a minimum resolution of two megapixels

that record at least 15 frames per second. The footage must be kept for a

minimum of 30 days.

The new rule would also require working lights that illuminate all sides of the

main building, parking area and any fuel pump stations. ATMs need to be secured

or bolted to the floor at least 12 feet away from glass windows and doors.

Store owners found violating the new rules could be fined up to $500.

dallasnew.com

King County ban on police use of facial recognition software spotlights local

movements across US

As federal legislation on law enforcement's use of facial recognition

software stalls, dozens of cities and counties are taking measures into their

own hands.

Facial recognition opponents rejoiced this week after the local government of

King County, Washington

voted to ban local police from using the technology.

The move was notable for a number of reasons. The ACLU of Washington

said in a statement that the new King County ban on police use of facial

recognition software was the first in the country to be county-wide and cover

multiple cities.

Electronic Frontier Foundation senior staff attorney Adam Schwartz added that it

was the most populous government body to institute a ban, with more than two

million residents within its borders. The ban was also hailed among privacy

advocates as a direct shot at Microsoft and Amazon, both of which have

headquarters in King County's biggest city: Seattle.

zdnet.com

Biden Leaves Security Providers on Chinese

Blacklist

Biden Expands Blacklist of Chinese Companies Banned From U.S. Investment

Move shows Biden’s willingness to continue some of the hard-line China

policies started by former President Trump

An executive order Mr. Biden signed Thursday brings to 59 the total number of

Chinese companies banned from receiving American investment and shows how his

administration is

continuing some of the hard-line China policies left by former President

Donald Trump.

The action is one of the firmest to date as the Biden administration conducts a

broad review of China policy, including how to deal with tariffs and other trade

measures taken by Mr. Trump. So far the administration has advanced few concrete

actions against Beijing, though the U.S. recently

joined allies in imposing sanctions against Chinese officials engaged in

the mass incarceration of mainly Muslim ethnic minorities in the Xinjiang

region.

wsj.com

Korn Ferry says expect more retail CEO turnover

Just eight new CEOs, which include heavyweights Amazon and Walgreens, manage

a big slice of retail with more than $1.7 trillion in market cap.

If you work in retailing, chances are you have a new

CEO — or you will soon.

Changes at the top began in earnest during the pandemic, and the momentum of new

CEO announcements will continue through 2021 “because new leaders are needed

to drive growth in this radically new retail environment,” according to a

new report from the largest executive search firm, Korn Ferry.

Most of the moves so far have been from founder/CEOs and longtime CEOs who

triggered succession plans. At Amazon, Walgreens, Ulta Beauty, Kendra Scott and

The Container Store, the new leaders were chosen to drive dramatic changes that

were planned even before the global health crisis forced the industry to

re-evaluate its future.

dallasnews.com

Benchmarking: Walmart gives 740,000 associates a

free Samsung smartphone

The

retailer is outfitting nearly half of its US workforce, amounting to

740,000 employees, with a free phone by the end of the year for personal and

professional use. The phone, a Samsung Galaxy XCover Pro, normally retails for

$499 and Walmart is giving employees a case and protection plan, too.

Walmart said the primary use of the phone is for its new employee app called

Me@Walmart, which the company explained in a release is meant to "simplify

daily tasks, serve our customers and plan for life outside of work."

Some of the app's features include scheduling, clocking in to their shift and a

voice-activated personal assistant for work that "saves time by letting

associates ask the app questions to quickly locate merchandise and get answers

for customers."

Walmart claims it doesn't have access to any personal data on the phone

and employees can access the app only while they're working. Prior to

this program, Walmart employees had to share company-owned smartphones and the

response following the initial test with personal phones was "good."

cnn.com

Macy's adds another 30 days on AP's to vendors

- Up 21.6% from LY

Some Companies Are Taking Longer to Pay Suppliers Despite Recovery

Macy’s and Mondelez are among the businesses negotiating longer payment terms

after getting used to them during the pandemic

Big U.S. companies on average took 58 days to pay suppliers in their

first quarters of fiscal 2021, up 5.5% from 55 days in the comparable

period last year, according to research from Hackett Group Inc.

For fiscal 2020, businesses took 62 days on average to settle their dues with

suppliers, up 7.6% from the previous year, Hackett said. The full-year

data set includes 1,000 companies.

“Term extensions have not gone away,” said Craig Bailey, an associate

principal at Hackett Group. Companies, particularly in industries hit hard by

the pandemic such as retail, remain

cautious about the year ahead as changes to consumer spending patterns

during the pandemic have made forecasting demand more difficult, Mr. Bailey

said.

Department-store operator Macy’s Inc. has benefited from longer payment

terms with its suppliers, Chief Financial Officer Adrian Mitchell said on a May

18 earnings call. It took the company 163 days on average to settle its bills

during the first quarter, up from 134 days a year earlier, up 21.6%,

according to Hackett. The company in its latest quarter had about $1.8

billion in cash on its balance sheet, up 18% from a year earlier.

wsj.com

Editor's Note: Just one example of many. As the solution providers

feel the final impact. A traditional role for everyone.

Amazon Hits the Bullseye - Fooling Everybody

in the Process

From $6B to $1B Price Tag in 5 Yrs - Amazon Wins in 5 Yrs

Staples Proposes To Acquire The ODP Corporation's Consumer Business for $1B

(Stores & Direct Channel business)

Editor's Note: In 2016 the FTC blocked the merger of Staples and Office

Depot shocking many who believed the merger was necessary to keep the companies

competitive with Amazon.

After several months of battling in court, the FTC blocked the approximately

$6 billion merger of Staples and Office Depot in 2016. While most seemed

shocked by the news, wondering why the FTC would block a deal that could

potentially help Staples and Office Depot keep up with the internet giant,

Amazon.

'There's no doubt Amazon was the big beneficiary of the merger falling

through'. Just follow the money. In 2016 Staples was willing to pay $6B and

today the price is $1B. That's $5B less in 5 years. So in essence Amazon cost

those two retailers $1 billion a year. Not to mention hundreds of jobs and lost

stock value for pension funds who failed to read the tea leaves and sell.

Now there's a lot more to the story, but leave it to say that the FTC thought

they knew better, the Judge over thought it and Amazon, who played a significant

role in the entire process including testifying in court, the FTC actually

studying their office supply business and strategy - and Amazon coming out

against the merger claiming it created a monopoly on the business services side.

Bottom line is that Amazon pulled the wool over everybody while they watched

Staples and Office Depot struggle in this harsh retail climate while Amazon

pointed their guns right at them. Which was the plan all along that the Judge

failed to see or recognize. With Amazon knowing full well were it would end up.

And quite frankly even with this proposed merger it's only a matter of time

before they dwindle even more.

Huge Boon to Crypto Currency - 1st C-Store

Chain Adopts it

Sheetz 622 C-stores to accept crypto currencies

The Flexa payment system

works by converting crypto currencies to their real-time dollar value as payment

to retailers. A few other retailers have piloted Flexa, including Barnes &

Noble, Bed Bath & Beyond, Crate & Barrel, GameStop, Lowe’s, Nordstrom, Office

Depot/OfficeMax, Petco, and Whole Foods Market.

retailleader.com

Quarterly Results

Costco May Comp's Up 22.8% overall, net sales up 24.2%

Nordstrom Q1 Brand net sales up 37%, Rack net sales up 59%, digital sales up

23%, total net sales up 44%

Five Below Q1 comp's up 162%, net sales up 197.6%

Lululemon Q1 company operated store revenue up 43.8%, E-commerce up 44.4%, sales

up 88%

Dollar General Q1 comp's up 4.9%, net sales up 0.6%

SpartanNash Q1 retail business unit comp's down 7%, retail unit net sales down

5.5%, food distribution segment net sales down 2.6%, overall net sales down 7%

Senior LP & AP Jobs

Market

Head of Asset Protection job posted for Ollie's Bargain Outlet in

Harrisburg, PA

The

Head of Asset Protection mitigates both external and internal security related

risks for the organization through the development and management of policies,

procedures, programs, and systems, across the Company. This position leads a

team to drive the Company’s operational audit process, partner and train field

teams on key operational drivers to reduce shortage and conduct investigations

into, fraud, abuse, or other misconduct.

indeed.com The

Head of Asset Protection mitigates both external and internal security related

risks for the organization through the development and management of policies,

procedures, programs, and systems, across the Company. This position leads a

team to drive the Company’s operational audit process, partner and train field

teams on key operational drivers to reduce shortage and conduct investigations

into, fraud, abuse, or other misconduct.

indeed.com

Last week's #1 article --

2

airlines will postpone serving alcohol amid surge of in-flight violence

Since Jan. 1, the Federal Aviation Administration has received about 2,500

reports of unruly behavior by passengers, including about 1,900 reports of

passengers refusing to comply with a federal mandate that they wear masks on

planes. "We have just never seen anything like this," Sara Nelson, the

international president of the Association of Flight Attendants, said during an

online meeting with federal aviation officials Wednesday. "We've never seen

it so bad."

startribune.com

|

All the News - One Place - One Source - One Time

Thanks to our sponsors/partners - Take the time to thank them as well please. If

it wasn't for them The Daily wouldn't be here every day for you.

|

|

&uuid=(email)) |

|

|

|

|

|

[Whitepaper] Combating a 55% Increase in BOPIS Fraud

Since the beginning of the Pandemic, there has been a 55% increase in the rate

of fraudulent attempts to purchase products online for in-store pickup.

Buy Online Pickup in Store (BOPIS) fraud was already a problem pre-COVID but

unfortunately the pandemic has only accelerated this issue. The percentage of

fraudulent BOPIS purchases is above average with companies reporting a loss

of 3-5% (with some as high as 10% or more).

Enabling the convenience of BOPIS without forsaking massive loss is the delicate

balance that Loss Prevention professionals now face which is why we've created

this easy guide to balancing BOPIS and LP.

This

white paper covers:

• Benefits & Challenges to BOPIS that every multi-unit brand should know

• The key indicators present during cases of BOPIS-related fraud

• Why analytics & reporting are at the heart of any successful BOPIS strategy

• And more...

Read Now

|

|

&uuid=(email)) |

|

|

|

|

First Time the FBI Director Takes a Public Stand

FBI Director Compares Ransomware Challenge to 9/11

Christopher

Wray points to Russian hackers, calls for coordinated fight across U.S. society Christopher

Wray points to Russian hackers, calls for coordinated fight across U.S. society

FBI Director Christopher Wray said the agency was investigating about 100

different types of ransomware, many tracing back to hackers in Russia, and

compared the current spate of cyberattacks with the challenge posed by the Sept.

11, 2001, terrorist attacks.

“There are a lot of parallels, there’s a lot of importance, and a lot of focus

by us on disruption and prevention,” Mr. Wray said in an interview Thursday.

“There’s a shared responsibility, not just across government agencies but across

the private sector and even the average American.”

Mr. Wray’s comments—among his first publicly since two recent ransomware attacks

gripped the U.S. meat and oil-and-gas industries—come as senior Biden

administration officials have characterized ransomware as an urgent

national-security threat and said they are looking at ways to disrupt the

criminal ecosystem that supports the booming industry. Each of the 100 different

malicious software variants are responsible for multiple ransomware attacks in

the U.S., Mr. Wray said.

“The scale of this problem is one that I think the country has to come to

terms with,” he said.

Complaints to the FBI and reports from the private sector show ransomware

incidents have tripled in the past year, Mr. Wray said. While private-sector

estimates of the toll to the U.S. economy vary, companies that track ransomware

generally put the cost at hundreds of millions or billions of dollars

annually and say it is rapidly increasing.

In the interview, Mr. Wray singled out Russia as harboring many of the known

users of ransomware.

wsj.com

Ransomware Gangs Now Treated Like Terrorists

Huge Move - High Priority Cases for DOJ & FBI Now

DOJ signals plans to coordinate anti-ransomware efforts with the same protocols

as it does for terrorism

The Justice Department signaled Thursday it plans to coordinate its

anti-ransomware efforts with the same protocols as it does for terrorism,

following a slew of cyberattacks that have disrupted key infrastructure sectors

ranging from

gasoline distribution to

meatpacking.

On Thursday, Deputy Attorney General Lisa Monaco issued an internal memo

directing US prosecutors to report all ransomware investigations they may be

working on, in a move designed to better coordinate the US government's tracking

of online criminals.

The memo cites ransomware -- malicious software that seizes control of a

computer until the victim pays a fee -- as an urgent threat to the nation's

interests.

The tracking effort is expansive, covering not only the DOJ's pursuit of

ransomware criminals themselves but also the cryptocurrency tools they use to

receive payments, automated computer networks that spread ransomware and online

marketplaces used to advertise or sell malicious software.

cnn.com

Follow-the-Money Rule In Effect Now

Tightening the Noose Around the Money Flow

WH exploring possible ways to trace transactions that line hackers’ pockets

White House officials this week said they are pushing to better trace

ransomware payments, which hackers demand to unlock companies’ data.

Some cybersecurity experts say the spate of attacks underscores the need for

a more aggressive approach to monitoring crypto payments. In April, a task

force of major tech companies and U.S. officials

called for governments to enforce know-your-customer rules, similar

to Treasury regulations, to improve transparency and accountability of bitcoin

and other digital money.

But hackers and the exchanges that process their payouts often operate overseas,

limiting Washington’s regulatory power. Improved oversight of cryptocurrency

exchanges abroad, which some cyber experts say face lower regulatory standards,

could require international cooperation or pressure.

Ransomware specialists, however, are skeptical that restrictions on bitcoin

payments or tighter regulations will slow the growth in ransomware.

Restrictions on individual digital currencies such as bitcoin mean criminals

will just switch to another, less-regulated, currency, and any regulation

strong enough to deter payments to criminals will take a long time to

develop.

“Virtually every exchange around the world is dealing in some form or fashion

with U.S. currency,” Mr. Alperovitch said. “The U.S. could absolutely pressure

all of them through sanctions and the like to adopt the same policies.”

wsj.com

Track Record & Reputation Impacts Loan Terms

The Unseen Cost of Data Breaches - But Your C Team

Knows!

Data Breaches Drive Higher Loan Interest Rates

Companies that experience a data breach may not suffer a long-term drop in stock

price, but will often have to pay higher loan interest rates and grant other

concessions, according to a study published this week.

The academic study, conducted by researchers at Yeshiva University in New York

City and Hong Kong Polytechnic University, found the

average company paid almost $3.7 million more in interest every year.

Businesses with a strong reputation for IT security, which

often have more favorable loan terms compared to their peers,

suffered more following a breach.

These results underscore how banks charge companies for the uncertainty

following a breach.

"After a breach, because of the direct and indirect costs, there is a lot of

uncertainty in respect [to] the company's future," he says. "What happens with

regulatory action? What happens with litigation? What happens if a major

customer leaves? It's uncertainty, and banks hate uncertainty."

darkreading.com

RaaS Syndicates - Equal-Opportunity Attackers - The Trend Will Continue

Ransomware-as-a-Service syndicates becoming

increasingly brazen

The True Cost of a Ransomware Attack

Companies need to prepare for the costs of an attack now, before they get

attacked. Here's a checklist to help.

Ransomware is an equal-opportunity attack, and any organization can become a

target. Therefore, every company should be preparing for this threat, not only

in terms of preventive measures like malware detection, network traffic

analysis, data leak prevention, and data backups, but also anticipating the

costs they should expect to pay.

In most of these cases, companies don't realize all the potential costs they may

incur during a ransomware attack.

Here is a list of some of the costs that companies need to prepare for now,

before they get attacked:

1. Cyber Insurance

Know what your deductible is as well. While this isn't a direct cost, it will

still cost you money.

2. Incident Response

The ransomware didn't just appear in your network. You need to figure out the

root cause, what the attackers did in your network, and what (if any) data was

taken. There are likely compromised users or systems with backdoors that weren't

affected by the ransomware still on your network. If you don't find them, this

attack will happen again in a few weeks.

Incident response (IR) companies help you figure all of this out. They come into

your organization, investigate the attack, and give you the assistance you need

to make it through containment, eradication, and recovery of the incident.

One tip: If you don't have an internal IR team, get an IR retainer. This will

have someone available to you 24x7x365 to assist if you have an incident.

Continue Reading

Russian Creator of Dark Web Marketplace DEER.IO - Only Gets 30 Months

3,000 Shops - $17M in Sales - Sold $1.2M in U.S.

Stolen Information

Russian Hacker Sentenced to 30 Months for Running a Website Selling Stolen,

Counterfeit and Hacked Accounts

Surprise: FBI Waiting for him when he got off the plane from Moscow at JFK -

Wow Rewards Must Work

SAN DIEGO – Kirill Victorovich Firsov, a Russian citizen, was sentenced to 30

months in custody for his role as the administrator of a website that

catered to cyber criminals by virtually selling items such as stolen credit card

information, other personal information and services to be used for criminal

activity.

The now-defunct online platform DEER.IO started operations as of at least

October 2013, and, as of Firsov’s arrest in March 2020, the platform hosted

approximately 3,000 active shops with sales exceeding $17 million. Although

Firsov maintained that the bulk of the sales on DEER.IO were Russian accounts,

the parties agreed that the government could show that shop owners on

the DEER.IO platform sold at least $1.2 million in

U.S.-based stolen information, to include the gamer accounts

identified in the plea agreement.

At sentencing, the prosecutor noted that Firsov built the DEER.IO platform in

2013 and maintained it for almost seven years.

Even though it sold stolen accounts, DEER.IO was not cloaked in secrecy and

required no special password for access, because everything was run out of

Russia, and American law enforcement could gain no foothold. On March 7,

2020, Firsov was arrested by the FBI in New York City when he flew into JFK

Airport from Moscow.

justice.gov

New: Promote Your PCI SSC Certification with a Digital Badge

The

PCI SSC offers a range of training

and certification programs to support businesses in their payment

security efforts. To help support the Council’s mission to educate and meet the

needs of payment industry professionals, PCI SSC has recently launched a

digital badging program. We talk with Travis Powell, Director of

Training Programs, to learn more about this new program. The

PCI SSC offers a range of training

and certification programs to support businesses in their payment

security efforts. To help support the Council’s mission to educate and meet the

needs of payment industry professionals, PCI SSC has recently launched a

digital badging program. We talk with Travis Powell, Director of

Training Programs, to learn more about this new program.

Travis Powell: Digital badging is a way to recognize individual

achievements and industry certifications. Most professionals may already

have been issued these types of badges through other industry certification

bodies such as ISC2, ISACA or even VMWare. Digital badging is a trusted source

by many industry organizations.

blog.pcisecuritystandards.org |

|

|

|

&uuid=(email)) |

|

|

&uuid=(email)) |

|

|

|

|

|

&uuid=(email)) |

|

|

|

|

|

Netflix

VP IT Guilty Taking Kickbacks From 9 Vendors

CEO corners him on forcing a program on his team

Former Netflix Executive Convicted Of Receiving Bribes And Kickbacks From

Companies Contracting With Netflix

Federal Jury Finds Former Netflix Vice President Guilty of Fraud for

Obtaining Pay-To-Play Bribes and Kickbacks from Tech Startups Seeking to Sell to

Netflix

SAN JOSE – A federal jury convicted Michael Kail, the former Vice President

of IT Operations at Netflix, of wire fraud, mail fraud, and money

laundering.

Kail was indicted May 1, 2018, of nineteen counts of wire fraud, three counts of

mail fraud, and seven counts of money laundering. The jury returned a verdict of

guilty on 28 of the 29 counts.

Kail, 49, of Los Gatos, was employed at Netflix as the Vice President in charge

of IT Operations from 2011 until July 2014.

As Netflix’s Vice President of IT Operations, Kail approved contracts to

purchase IT products and services from smaller outside vendor companies and

authorized their payment. The evidence demonstrated that Kail accepted bribes

in ‘kickbacks’ from nine tech companies providing products or services to

Netflix. In exchange, Kail approved millions of dollars in contracts for goods

and services to be provided to Netflix. Kail ultimately received over

$500,000 and stock options from these outside companies. He used his

kickback payments to pay personal expenses and to buy a home in Los Gatos,

California, in the name of a family trust.

Editor's Note: The story surrounding the other 8 vendors and how he

eventually put himself in a corner with Netflix's CEO after trying to force the

IT team to use a software program they didn't like, culminates in his departure

and eventual arrest. Leave it to say he got greedy and went way overboard

thinking he couldn't get caught.

Kail faces a maximum sentence of twenty years in prison and a fine of $250,000,

or twice his gross gain or twice the gross loss to Netflix, whichever is

greater, for each count of a wire or mail fraud conviction, and ten years in

prison and a fine of $250,000 for each count of a money laundering conviction.

justice.gov

Treating it the same as alcohol

Amazon Drops Marijuana Screening, Supports Federal MORE Act

Congress is considering several bills to legalize cannabis

Amazon is adjusting its drug-testing policy for U.S. field operations teams

and will no longer screen for marijuana in many circumstances, according to

a June 1 announcement. Clark said the online retail giant will continue to

monitor for on-the-job impairment and conduct post-incident drug and alcohol

tests.

"In the past, like many employers, we've disqualified people from working at

Amazon if they tested positive for marijuana use,"

said Amazon retail executive Dave Clark. "However, given where state laws

are moving across the U.S., we've changed course. We will no longer include

marijuana in our comprehensive drug-screening program for any positions not

regulated by the Department of Transportation and will instead treat it the

same as alcohol use."

shrm.org

Miami Serial Porch Pirate Gets 10 Yrs Federal Prison

On supervised release from robbing a letter carrier when he got busted this

last time

Miami, Florida – A 26-year-old Miami man has been sentenced to 10 years in

federal prison for stealing mail and packages from mailboxes, porches, and other

outside areas of several homes in Miami and Coral Gables.

Yunior L. Blanco-Pedroso, was pulled over on September 8, 2020, while driving a

blue BMW. Inside the BMW, officers discovered mail, packages and checks

addressed to other people that Blanco-Pedroso had stolen. Blanco-Pedroso

later admitted to committing 10 porch burglaries between August and

September 2020 in Miami and Coral Gables. Other evidence in the case included

home surveillance recordings showing Blanco-Pedroso following delivery

trucks, walking up to front doors to steal packages, and stealing mail from

mailboxes. When he committed these burglaries in 2020, Blanco-Pedroso was on

supervised release following a previous conviction and sentence for robbing a

letter carrier.

justice.gov |

&uuid=(email))

|

|

|

|

&uuid=(email)) |

|

|

&uuid=(email))

|

|

DOJ Cases - Totaling 39 Suspects - Over $5 Million

Is this the Kmart Breach from 2017?

Biggest Data Breach Bust Yet - This is a first! Arrested 22 of the Street Level

End Users 4 Yrs Later

Federal Indictment Charges 22 Individuals With Purchasing and Using Payment

Cards Stolen From National Retail Chain

Chicago

- Twenty-two individuals have been indicted on fraud and identity theft

charges for allegedly purchasing and using credit, debit, and gift cards

that were stolen in a cyber attack from a national retain chain. Chicago

- Twenty-two individuals have been indicted on fraud and identity theft

charges for allegedly purchasing and using credit, debit, and gift cards

that were stolen in a cyber attack from a national retain chain.

According to an indictment unsealed in the Northern District of Illinois, the

cyber attack occurred in 2016 and 2017 when an individual installed a

malicious software program on multiple computers of the retail chain, which is

headquartered in the Chicago area. The malware allowed the co-schemer to

capture data from more than three million payment cards, including credit

cards, debit cards, and gift cards, that had been used at more than 400

of the company’s retail stores. The co-schemer then sold the card data

for $4 million in bitcoin to another individual, who in turn sold it

online to thousands of others, including the 22 charged defendants, the

indictment states.

The defendants used data from the cards to purchase items at businesses

throughout the country, including restaurants, gas stations, and hotels, the

charges allege. At least 80 people were victimized by the defendants’ conduct,

the indictment states.

Twenty defendants were arrested this month and have begun making initial

appearances in federal courts throughout the country. Two defendants

remain at large and are believed to be residing overseas. The investigation

remains ongoing.

Wire fraud is punishable by up to 20 years in federal prison, while

aggravated identity theft carries a mandatory, consecutive prison sentence of

two years. If convicted, the Court must impose a reasonable sentence under

federal statutes and the advisory U.S. Sentencing Guidelines.

justice.gov

Editor's

Note: This has got to be the Kmart data breach from May 31, 2017.

As Krebs reported on his blog here. With a number of indicators:

Headquartered in Chicago, more than three million cards used in over 400

stores - at the time Kmart had 735 stores. And no one else in Chicago

with those store numbers reported a breach over the two year period the DOJ

mentions. Editor's

Note: This has got to be the Kmart data breach from May 31, 2017.

As Krebs reported on his blog here. With a number of indicators:

Headquartered in Chicago, more than three million cards used in over 400

stores - at the time Kmart had 735 stores. And no one else in Chicago

with those store numbers reported a breach over the two year period the DOJ

mentions.

Interesting points of the case: The initial hacker sold the 3 million cards

for $4 million in 'bitcoin,' the middle man sold those cards to 'thousands

of others'. Which meant they moved quickly. Remember they're being tested along

the way to make sure they're still valuable. And they were used nationwide.

Busting these 22 means the FBI has been tracking them for over 4 years. Which

means they aren't giving up on pursuing old cases that are wide spread.

Indeed sending a message to the criminal gangs worldwide: Use the info and we're

going to come after you!

Counterfeit Gang of 9 Hitting Walmart for $1M+

Baltimore Man Sentenced to 5+ Years as Part of Nationwide Scam to Pass

Counterfeit Checks Worth Over $1 Million

Robert

Sean Harrington, 42, of Baltimore, MD, was sentenced to five years and four

months in prison, three years of supervised release, and ordered to pay

restitution in the amount of $204,066.

Harrington was one of nine men charged in a Superseding Indictment as part of a

coordinated scheme that operated for over two years, between June 2016 and July

2018, with the purpose of committing identity theft in order to defraud various

banks and Walmart, Inc., by presenting and cashing over $1,000,000 worth of

counterfeit checks at Walmart stores throughout the United States.

All nine defendants in this case pleaded guilty to similar charges; many were

previously sentenced and received the following sentences from Judge Leeson:

Ahmad Becoate, 34, of Philadelphia, PA, was sentenced to 75 months in prison;

Jeffrey Roach, 35, of Baltimore, MD, was sentenced to 94 months in prison;

Jethro Richardson, 42, of Greensboro, NC, was sentenced to 70 months in prison;

Nathaniel Jones, 41, of High Point, NC, was sentenced to 24 months in prison;

Leander Rowell, 44, also of Greensboro, NC, was sentenced to 87 months in

prison; and Brian Cherry, 45, of Charlotte, NC, was sentenced to 70 months in

prison. All defendants were also ordered to pay substantial amounts of

restitution.

“This was a sophisticated scheme involving many defendants that took excellent

investigative work to unravel,” said Acting U.S. Attorney Williams.

justice.gov

Four men get 2 Yrs 6 months + 2 Yrs each - Buying $2.3M worth of cigarettes from

Sam's Club stores in Atlanta using stolen credit cards

Mamadou Sow, Demarcus Myree, Boubacar Tivalo, and Jacob James, have been

sentenced for access device fraud and aggravated identity theft related to

purchases of massive quantities of cigarettes from Sam's Club retail locations

in metro Atlanta.

Mamadou Sow, Demarcus Myree, and Boubacar Tivalo obtained Sam's Club memberships

and membership cards in their names and aliases. From September 2018 through

November 30, 2018, the defendants used dozens of stolen credit cards, issued by

various financial institutions, to make unauthorized purchases of cigarettes at

Sam's Club retail locations throughout metro Atlanta. In combination with some

cash transactions, these three defendants purchased over $1.7 million worth

of cigarettes during the scheme. Myree was also charged with possession of a

stolen firearm.

From September 2018 to December 2018, Jacob James, who was charged in a

separate indictment, purchased over $635,000 worth of cigarettes from Sam’s Club

stores using stolen credit cards.

Mamadou Sow, a/k/a Moussa Sow, 30, of Guinea, was sentenced to two years, six

months in prison, to be followed by two consecutive years

imprisonment for aggravated identity theft. He was also sentenced to serve

three years of supervised release and ordered to pay restitution in the

amount of $749,772.31.

Demarcus Myree, a/k/a Yuri Markosov, 27, of Atlanta, Georgia, was sentenced to

two years, six months in prison for access device fraud and possession of

a stolen firearm, to be followed by two consecutive years imprisonment

for aggravated identity theft. He was also sentenced to serve two years of

supervised release and ordered to pay restitution in the amount of

$339,545.42.

Boubacar Tivalo, a/k/a Tivado Boubacar, 46, of Guinea, was sentenced to two

years, six months in prison for access device fraud, to be followed by

two consecutive years imprisonment for aggravated identity theft. He was

also sentenced to serve three years of supervised release and ordered to

pay restitution in the amount of $664,305.52.

Jacob James, a/k/a Mark Johnson and Joe Johnson, 31, of Atlanta, Georgia, was

sentenced to two years in prison for access device fraud, to be followed

by two consecutive years imprisonment for aggravated identity theft. He

was also sentenced to serve three years of supervised release and ordered to

pay restitution in the amount of $635,242.75.

justice.gov

Former Cell Service Associates and Co-Conspirator Facing Federal Indictment for

Aggravated Identity Theft, Conspiracy to Commit Wire Fraud, and Wire Fraud

Allegedly Fraudulently Stole over $500,000 Worth of Cell Phones using the

Personal Information of at least 17 Victims

Baltimore, Maryland – A federal grand jury has returned an

indictment charging four individuals for conspiracy to commit wire fraud, wire

fraud, and aggravated identity theft. The indictment was returned on April 29,

2021 and unsealed on May 13, 2021 upon the arrest of the final defendant. The

four defendants are:

Reginald McElrath, age 40, of Cockeysville,

Maryland;

Chantelle Harris, age 33, of Hyattsville, Maryland;

Robert Patterson age 21, of Odenton, Maryland and;

Danisha Thomas age 37, of Bladensburg, Maryland.

From July 2019 to January 2020, McElrath, Harris, Patterson, and Thomas

allegedly used the identifying information of at least 17 individuals to

obtain new cell phones. McElrath, Harris, and Patterson worked in Maryland

for a vendor contracted by a multinational retail corporation to handle all

contractual wireless phone transactions in their stores. The indictment alleges

that McElrath, Harris, and Patterson used their positions to apply for new cell

phone accounts with various carriers and to apply for upgraded cell phones on

existing cell phone accounts in the victims’ names using the PII of the victims

without their knowledge or permission. McElrath, Harris, and Patterson

allegedly charged purchases of new cell phones to fraudulent cell phone service

accounts they opened in the victims’ names and none of the costs were borne

by members of the conspiracy.

The indictment also alleges that co-conspirators, including Thomas, would

receive the fraudulently obtained cell phones directly from McElrath, Harris,

Patterson and others from inside the retail store.

In sum, the defendants allegedly used the stolen PII of 17 individual victims

to fraudulently obtain at least $537,000 worth of cell phones.

They face a maximum sentence of 20 years in prison for wire fraud and a

mandatory minimum of two years in prison, consecutive to any other

sentenced imposed, for aggravated identity theft.

justice.gov

California man arraigned for his role in $490,000 phone trade-in scheme

David Shemtov has been arraigned after being charged with eight counts of wire

fraud for his role in a scheme to fraudulently inflate the reimbursement

value of more than 1,400 electronic devices that he submitted for trade-in.

“Shemtov allegedly found a way to exploit this process to

recover many times the value of the actual devices he traded in.”

From approximately October 2019 through January 2020, Shemtov allegedly

participated in a scheme to submit more than 1,400 fraudulent electronic device

trade-in requests online. On Internet trade-in request forms, the trade-in

requests purported to have newer, higher-valued devices, typically an iPhone XS

Max, to trade in. In reality, Shemtov never intended to trade in the

higher-valued devices identified in the trade-in requests. Instead,

substantially less valuable devices–typically iPhone 6s and 7s–were sent in.

The device trade-in process was handled by a third-party provider (the victim

company) that oversaw the mailing and receipt of the devices, and the

reimbursement payments, typically in the form of Apple gift cards. The victim

company paid substantially more than the true value for the devices sent in as

part of the scheme. For instance, more than 900 of the trade-in requests claimed

to have iPhone XS Max with 64 gigabyte capacity, for a value of $545, but the

devices mailed in were various versions of iPhone 6’s, with a trade-in value of

$30. 900 x $545 = $490,500 vs 900 x $30 = $27,000

After the victim company detected the scheme, from about March 2020 through

December 2020, Shemtov submitted more than 1,000 additional trade-in requests

using more than 100 fictious names. The victim company flagged these requests

and did not complete the trades.

justice.gov

CC Fraud Ring of 4 Hit Retail Chains for Over

$450,000 in Southeast & Get Fed Prison Time

Members Of Identity Theft Ring Operating In Three States Are Sentenced To Prison

CHARLOTTE, N.C - Four members of an identity theft ring operating in at least

three states have been sentenced to prison.

Dayton Louis Kolczak, 29, and Heather Westerfield, 37, both of Charlotte, to

71 months and 57 months in prison, respectively, and ordered each to serve

three years under court supervision. Both Kolczak and Westerfield previously

pleaded guilty to bank and wire fraud conspiracy and aggravated identity theft

charges. Two other co-defendants, Kenneth D. Bennett-Rosario, 45, of Charlotte,

and Jessica Bailey Sowell, 28, also of Charlotte, previously pleaded guilty to

aggravated identity theft. Bennett-Rosario was sentenced to 39 months in

prison, and Sowell was ordered to serve 24 months for their role in the

scheme.

Stealing mail, info over the internet, real estate listings and other public

records they created counterfeit NC & SC drivers licenses in victims names with

their pictures and obtained credit cards.

According to court records, the co-conspirators used the counterfeit

identification cards and stolen identities to obtain over $450,000 in

fraudulent credit card accounts at retail store chains, such Lowe’s, Belk

Department Stores, Kohl’s, and Target, to purchase or rent luxury vehicles, pay

for rooms at various hotel chains, and to rent storage units, among other

things. According to court records, in this manner, the co-conspirators used the

stolen identities of at least 40 individuals. Over the course of the

investigation, law enforcement seized printers, laptop computers, an embossing

machine, a laminator, and other devices used to manufacture the fraudulent

identification cards.

justice.gov

CC Fraud Duo - 1 Gets 5 Yrs & The Other Pleads

Guilty

Jacksonville Woman Pleads Guilty To Aggravated Identity Theft And Fraud Charges

Jacksonville, Florida – Zipporan Carmel Peters (32, Jacksonville) has

pleaded guilty to aggravated identity theft and conspiracy to commit bank

fraud. Peters faces up to 30 years in federal prison on the conspiracy to

commit bank fraud charge, a 2-year mandatory minimum term of imprisonment on the

aggravated identity theft charge, and payment of restitution to the victims she

and her co-defendant, Charles Cornelius Smith, defrauded. A sentencing

date has not yet been set.

Smith obtained the PPI, including the name, date of birth, and Social Security

number of a victim. Smith provided Peters with a counterfeit South Carolina

driver licenses with Peters’ photo on it.

Using the victim’s identity, Peters made various fraudulent transactions

involving the withdrawal of large amounts of cash and the purchase of

multiple $500 gift cards, utilizing the victim’s account. Smith and Peters

also visited multiple cellphone stores in Clay and Duval Counties and

used the victim’s identity to obtain several thousand dollars’ worth of

cellphones and accompanying merchandise.

On May 27, 2021, sentenced Charles Cornelius Smith (35, Jacksonville) to five

years in federal prison for aggravated identity theft and conspiracy to

commit bank fraud. The court also ordered Smith to pay restitution to the

victims he and Peters defrauded.

justice.gov

Interesting Point: Both Counterfeiters Were

Busted While Still on Federal Supervised Release - Just got out of

Federal Prison

Wonder if they were part of the early release

program.

East Stroudsburg, PA., Man Gets 18 Months’ For Passing Counterfeit Currency at

Multiple Walmart Supercenters

Battle engaged in this conduct at a time when he was still serving a prior

federal sentence for a handgun offense and was required to reside in a

halfway house in Brooklyn, New York.

justice.gov Battle engaged in this conduct at a time when he was still serving a prior

federal sentence for a handgun offense and was required to reside in a

halfway house in Brooklyn, New York.

justice.gov

Tampa Man Gets 51 Months For Manufacturing Counterfeit Federal Reserve Notes

While On Federal Supervised Release

Darius Jondi Edwards (42, Tampa) pleaded guilty on January 25, 2021. After his

release from prison in October 2019, and while still on federal supervised

release for those prior counterfeiting charges, the Pinellas Park Police

Department arrested Edwards for possession of counterfeit currency and

forging/making counterfeit bank bills. During the course of arresting Edwards at

a hotel, law enforcement found him to be in possession of counterfeit currency,

partially completed counterfeit currency, and computer media used to manufacture

counterfeit Federal Reserve notes.

justice.gov

Portland, OR: Felony Lane Gang Member Sentenced in Bank Fraud Scheme

A Fort Lauderdale, Florida man was sentenced to federal prison today for his

role in a bank fraud and identity theft scheme targeting female victims in the

Portland Metropolitan Area. Damian Fletcher, 27, was sentenced to three years in

federal prison and three years’ supervised release. According to court

documents, Fletcher is a member of the Felony Lane Gang, an interstate criminal

organization based in Florida that travels to locations throughout the U.S. to

commit vehicle break-in and fraud sprees. The organization targets female

victims who leave their purses, wallets, and valuables in parked cars. After

victims exit their vehicles—often to drop off children, run errands, or visit a

gym—Felony Lane Gang members break into the vehicle to steal targeted items.

After the theft, conspirators quickly deploy associates to conduct fraudulent

bank or merchant transactions using stolen identification, checks, and credit or

debit cards.

In the fall of 2019, Fletcher and five co-conspirators traveled to Portland to

target local victims. Once Fletcher and his partners stole items from a vehicle,

they checked to see if one of several female co-conspirators resembled the

victim. If one of their female co-conspirators could impersonate the victim,

they would attempt to cash fraudulent checks written in the impersonated

victim’s name. The conspirators would cash checks at various local banks.

Investigators identified 32 vehicle thefts and 22 instances of bank fraud

committed during Fletcher’s most recent known Oregon crime spree. In total,

this spree resulted in a financial loss of more than $98,000. Fletcher was

arrested on March 9, 2020 in Florida.

On June 6, 2020, a federal grand jury in Portland returned a 14-count

superseding indictment charging Fletcher and five co-defendants with conspiring

to commit bank fraud, bank fraud, and aggravated identity theft. On January 7,

2021, Fletcher pleaded guilty to conspiring to commit bank fraud and aggravated

identity theft. During sentencing, U.S. District Court Judge Michael W.

Mosman ordered Fletcher to pay $98,733 in restitution. Co-defendants Delvin

Mills, 29, of Lauderdale Lakes, Florida; Megan Spurlock, 27, a Washington State

resident; and Linda Marie Lupo, 52, of Deerfield, Florida; have all pleaded

guilty and are awaiting sentencing. Co-defendants Justin Curry, 28 of Fort

Lauderdale, and Treveon Donte Jordan, 23, of Lauderdale Lakes, are on pre-trial

release pending a four-day jury trial scheduled to being on June 15, 2021.

justice.gov

Chicago, IL: Women Steal Display Racks Full of Purses From Old Orchard Center

Nordstrom

Police in suburban Skokie are searching for suspects after a group of women

entered a Nordstrom location at Old Orchard Center and grabbed several

display racks containing high-end handbags, scarves and socks valued at more

than $10,000 in total. According to police, one of the women also threatened

a loss prevention agent at the store with a bolt cutter before fleeing the

scene. At approximately 11:12 a.m. Tuesday, authorities were called to the store

following a retail theft and assault, according to a press release. Four women

had entered the store and proceeded to grab the display racks, carrying them out

of the store.

nbcchicago.com

Roseville, CA: 3 People Accused Of Stealing Over $4,000 In Alcohol From

Roseville-Area Stores

Calgary, AB, CN: $60K worth of lumber stolen from truck as price of wood soars

in Canada

f%20(1).png) |

|

|

&uuid=(email)) |

|

|

&uuid=(email))

|

|

|

|

&uuid=(email)) |

|

|

Shootings & Deaths

Virginia Beach, VA: 7-Eleven customer who shot two robbers in Va. Beach, killing

one, won’t be charged

A 7-Eleven customer who shot two robbery suspects — killing one of them — in

Virginia Beach will not be facing any charges. The double shooting happened at

store on Newtown Road on July 25 — and ended an armed robberies spree that

involved three suspects and several convenience stores across Southside Hampton

Roads. Virginia Beach police said two suspects entered the Newtown Road store

and tried to rob the clerks at gunpoint. A customer inside the store, who was

legally carrying a gun, shot both suspects. One of the suspects, 18-year-old

Michael Moore, died at the scene and the other was transported to a local

hospital. An officer found a third suspect near the 7-Eleven and took him into

custody, police said. A spokesperson for Virginia Beach Commonwealth’s Attorney

Colin Stolle confirmed to 10 On Your Side the customer will not be charged.

Another customer who was also in the store that day, Barrie Engel, started a

Facebook fundraiser for the fellow customer whom she has described to as a

“hero.”

wrbl.com

Philadelphia, PA: Police ID Dunkin' store manager killed during robbery;

suspect sought

Philadelphia

police are searching for the suspect who gunned down a Dunkin' store manager in

North Philadelphia. The incident happened Saturday around 5:30 a.m. on the 500

block of W. Lehigh Avenue. Police say the store manager, Christine Lugo, 41, was

opening the shop when she was approached by an armed man and forced into the

business. Once inside, the suspect demanded she hand over money from the store

office. After taking the money, the suspect shot Lugo in the head. She was

pronounced dead at the scene.

6abc.com Philadelphia

police are searching for the suspect who gunned down a Dunkin' store manager in

North Philadelphia. The incident happened Saturday around 5:30 a.m. on the 500

block of W. Lehigh Avenue. Police say the store manager, Christine Lugo, 41, was

opening the shop when she was approached by an armed man and forced into the

business. Once inside, the suspect demanded she hand over money from the store

office. After taking the money, the suspect shot Lugo in the head. She was

pronounced dead at the scene.

6abc.com

Norfolk, VA: Man charged with murder in shopping center shooting

A Virginia man has been charged with second-degree murder after he and another

man were shot in a shopping center in Norfolk. Police said in a news release

that 42-year-old Fareed Nelson-Luckett has been charged in the shooting. Police

were called Friday afternoon about a shooting in a shopping center near Norfolk

State University. Officers found Nelson-Luckett and 37-year-old Calvin Durham II

suffering from gunshot wounds. Both men were taken to Sentara Norfolk General

Hospital, where Durham later died. Police said Nelson-Luckett was still being

treated at the hospital for injuries not considered life-threatening. He will be

taken to the Norfolk City Jail when he's released from the hospital.

heraldcourier.com

Chicago, IL: 14-year-old girl dies 3 days after being shot on Southwest Side

Savanah Quintaro was pronounced dead Saturday, three days after being shot

outside of a convenience store in the 4800 block of South Wood Street on

Wednesday afternoon.

wgntv.com

Katy, TX: Employee shoots at suspects during smash-and-grab at Katy Mills

jewelry store

Shots

were fired inside Katy Mills Mall Friday evening when police say a jewelry store

employee saw two suspects break into a display case. According to police, the

two masked men walked into the jewelry store in the mall, used a nail gun to

smash one of the display cases and then took jewelry. An employee pulled out a

gun and fired several shots at the suspects, police said. It's unknown if either

of the suspects was hit, but police said they were able to get away in a white

SUV. Fortunately, there were no reports of injuries in the mall.

khou.com Shots

were fired inside Katy Mills Mall Friday evening when police say a jewelry store

employee saw two suspects break into a display case. According to police, the

two masked men walked into the jewelry store in the mall, used a nail gun to

smash one of the display cases and then took jewelry. An employee pulled out a

gun and fired several shots at the suspects, police said. It's unknown if either

of the suspects was hit, but police said they were able to get away in a white

SUV. Fortunately, there were no reports of injuries in the mall.

khou.com

Wichita, KS: Woman convicted in connection with Menard’s robbery, shooting of LP

sentenced to more than 3 years

A

woman convicted in a 2018 shooting in northwest Wichita will spend more than

three years in prison. A Sedgwick County District Court judge on Wednesday, June

2, sentenced Mia Hidalgo to 40 months. Wichita police arrested Hidalgo in

2018 for her involvement in a robbery at Menards in northwest Wichita that ended

with a loss prevention officer being shot and injured. She was 17 at the

time. Hidalgo confessed to attempted robbery in the case.

kwch.com A

woman convicted in a 2018 shooting in northwest Wichita will spend more than

three years in prison. A Sedgwick County District Court judge on Wednesday, June

2, sentenced Mia Hidalgo to 40 months. Wichita police arrested Hidalgo in

2018 for her involvement in a robbery at Menards in northwest Wichita that ended

with a loss prevention officer being shot and injured. She was 17 at the

time. Hidalgo confessed to attempted robbery in the case.

kwch.com

Warren, MI: Police searching for woman involved in fatal shooting at 7-Eleven

Robberies,

Incidents & Thefts

Man Attacks Security Guard & Two Female

Employees/Owners

Charges upgraded to hate crime against Baltimore man accused of ‘rampage’ of

Asian-American owned liquor stores

Authorities

have brought hate crime charges against a Northeast Baltimore man accused of

going on a rampage last May at three liquor stores owned by Asian-American

families in the city. Authorities

have brought hate crime charges against a Northeast Baltimore man accused of

going on a rampage last May at three liquor stores owned by Asian-American

families in the city.

Darryl Doles, 49, is accused of attacking one store’s security guard with a

piece of lumber, shouting at another store owner “F--- the Chinese,” then

bashing two Korean-American women in the head with a cinder block.

A Baltimore grand jury indicted him on charges of attempted murder in

addition to the hate crimes.

According to the indictment, surveillance cameras captured Doles pushing his way

inside Wonder Land Liquors on Pennsylvania Avenue, wrestling with the

67-year-old woman inside and falling to the ground. He allegedly grabbed her by

the hair and hit her three times in her head with the cinder block.

Then he bashed the woman’s 66-year-old sister in her head when she tried to

help, according to the indictment.

baltimoresun.com

Serial Fraudster Gets Six Yrs+ for SNAP Fraud Schemes With Losses of $1M+

Baltimore, Maryland – Robert Lee Snowden Jr., age 45, of Owings

Mills, Maryland, gets 78 months in federal prison, followed by three years of

supervised release, for conspiracy to commit wire fraud and for aggravated

identity theft, in connection with a series of fraud schemes perpetrated between

2013 and 2020. Additionally, ordered Snowden to pay restitution of

$1,021,583.72.

From 2013 to July 16, 2020, Snowden conspired to defraud the Maryland Department

of Human Services (DHS) and the Federal Supplemental Nutrition Assistance

Program (“SNAP”), formerly known as the “Food Stamp Program,” by using

victims’ stolen identification information to obtain SNAP benefits. Snowden

sold the SNAP benefits for cash at approximately 50% of the value of the

benefits on the SNAP card.

justice.gov

Lengthy & On-Going Investigation Results In Four Houston Area Men Charged In

Mid-State ATM Thefts

21 ATM Thefts or Attempts in Middle TN During Past Year Resulting in More

Than $732,000 Loss

NASHVILLE – Four Houston, Texas men are facing federal charges after a

lengthy investigation by the FBI into a series of Automated Teller Machine (ATM)

thefts in middle Tennessee and elsewhere,

Elijah Diaz, 19; Troy Alan Parker, 18; Willie Charles White, 21; and Abraham

Woods, 32, were arrested on the morning of April 26, at a hotel in Holladay,

Tennessee, and charged with conspiracy and bank larceny, following the theft

from an ATM machine in Mount Juliet, Tennessee, hours earlier.

For over a year the FBI Violent Crimes Task Force in Nashville has been

investigating ATM thefts. Typically, the method of these thefts involve crews of

individuals who steal a heavy duty capacity pickup truck, obtain large J-hooks

and an industrial chain and then scout a free-standing ATM to target. These

crews then use the stolen truck and approach the ATM in the early morning hours,

wearing hoodies and masks. The shell of the ATM is then pried open and the

J-hooks are attached to the safe and to the truck. The truck is then used to

pull open the safe door, allowing access to the cash inside. After travelling to

a pre-determined location, the crews offload the cash into other vehicles and

abandon the stolen truck to avoid detection and apprehension.

The FBI followed the gang on numerous separate occasions from Tenn. to Texas at

various ATM locations and arrested them on April 26th after one heist in Mount

Juliet, Tenn. They all face up to 10 years in prison.

justice.gov

Fort Smith, AR: Arkansas man who robbed taco shop with water pistol asks for

clemency again after 40 years in prison

In February 1981, Rolf Kaestel, armed with a toy water pistol, robbed an

Arkansas taco shop of $264. He’s been incarcerated for 40 years for the crime.

Kaestel was 29 when he robbed the shop. He turned 70 on June 2. He was sentenced

on June 5, 1981 to life in prison and a $15,000 fine for aggravated robbery. The

man who managed the taco shop, and handed Kaestel the money during the robbery,

has recommended his release. Dennis Schluterman appealed to then-Governor Mike

Beebe in a YouTube video on Oct. 29, 2014. Kaestel is awaiting a decision from

Arkansas Gov. Asa Hutchinson on another clemency application. The governor has a

little more than 90 days to make a decision. In 2015, Hutchinson denied Kaestel

clemency. Kaestel is part of the Arkansas Department of Corrections’ Interstate