|

Is this an LP Resurgence?

LP Payroll Gaining Traction For Q4

Start Your Engines - The Holiday Season is Coming

By Gus Downing, Publisher & Editor, D&D Daily By Gus Downing, Publisher & Editor, D&D Daily

With three VP of LP jobs and seven Director

jobs on the market, it's a busy time for senior LP jobs heading into the fourth

quarter.

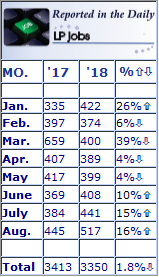

Take this Q4 senior push and couple it with the 10% and 15% increase in job

postings in June and July respectively, and we're seeing the strongest job

market since before the great recession.

Obviously retailers are loosening payroll compared to last year's 21% and 15%

drops in June and July. That's a huge swing of 30% and 31% respectively.

If we just took March's 39% drop in job postings out of the equation, which

coincidently enough almost timed perfectly with the Macy's and Toys R Us impact,

we'd have an extremely strong job market for 2018 and probably one of the best

in over a decade.

we just took March's 39% drop in job postings out of the equation, which

coincidently enough almost timed perfectly with the Macy's and Toys R Us impact,

we'd have an extremely strong job market for 2018 and probably one of the best

in over a decade.

Even with a 10% error ratio, the numbers we're seeing are still up 20% and 21%

respectfully. Which is still extremely strong and quite frankly our numbers are

fairly accurate given our search model and the fact that we don't include 30 day

re-posted jobs.

This job growth reflects a number of things. From increased comp's, payrolls

sliced to bare bones for years, fear of the retail apocalypse subsiding a

little, or at least the media has calmed down about it with a few creditable

journalist even labeling this a "retail renaissance".

Yes, we have Sears, JC Penney, and a group of retailers walking on banana peels

and yes we'll feel those job loses. But all in all some retailers are figuring

digital out and if there's anything that's been helping retailers, it's been

e-commerce and on the flip side that's the one factor that's also worked against

the LP industry, because if it's not about digital the retailer isn't spending.

The other huge factors, are that once the retailers saw the positive comp's they

recognized the need to increase LP jobs because of the increased violence,

almost weekly active shooters, and the need to 'Protect' brand reputation.

We also have cyber crime exploding with it's ripple effect throughout the retail

enterprise and we have the 2015 spike in robberies that hasn't subsided and is

still moderately increasing. And lastly we have the acknowledgement, finally in

the

National

Retail Security Survey (NRSS), that ORC is the biggest factor driving shrink from a theft standpoint. We also have cyber crime exploding with it's ripple effect throughout the retail

enterprise and we have the 2015 spike in robberies that hasn't subsided and is

still moderately increasing. And lastly we have the acknowledgement, finally in

the

National

Retail Security Survey (NRSS), that ORC is the biggest factor driving shrink from a theft standpoint.

Certainly the NRSS findings show improvement and some notable decreases. However

when Houston and almost the entire state of Florida is shut down for months

during the busiest time in retail, the top retail crime states in almost every

category, the figures were impacted and there's no way to adjust for that other

than to recognize it and explain it to your senior management teams who may be

influenced by the results.

On that note we also have to recognize that retailers closed over 10,000 stores

last year. With the vast majority being underperforming units that usually also

represent the most challenging, difficult markets with higher shrink numbers.

Thereby impacting the overall shrink results industry wide as well.

With that said we may be experiencing an LP resurgence in retail America. After

years of job losses and increasing store counts, some of which was technology

driven, we may be seeing a upward trend that shows the importance, need, and

impact that every Loss Prevention executive position has and can make.

Never before have we faced such a challenging time. With a brands total

reputation at stake based on real-time viral internet posts, the LP executive

today not only has to be the first responder but they also have to be the most

talented ambassador in the organization.

Let's hope that these new jobs and executives are successful because your brands

reputation is at stake and you have much more of an impact on it than you think.

Just some thoughts -Gus Downing

|