|

Using Analytics to Derail

Fraud Before It Happens

Advanced cognitive solutions could potentially enable organizations to assess

fraud and corruption risk on a broader scale, with far greater precision and

efficiency, as discussed in a recent Deloitte webcast,

The Future of Investigations: Derailing Fraud Before It Happens.

The new approaches to risk management of fraud and corruption are being driven

by rapid changes in analytics. “This advanced technology — in the hands of

experienced investigators and paired with the abilities of data scientists and

other analytics professionals — enables the organization to take the fight

against fraud to a new level,” says

Don Fancher, a principal at Deloitte Financial Advisory Services LLP and

Deloitte Forensic’s global leader.*

There may well be a regulatory benefit as well, since U.S. regulators have

invested significantly in analytics to better identify potential fraud schemes,

and increasingly expect organizations to utilize advanced technology to monitor

potential fraud and corruption risks.

“Regulators will, of course, be interested in an organization’s response to

known issues, but also will likely inquire about technology tools and solutions

designed to understand the entity’s fraud and corruption exposures based on

industry, geography, and business practices. Building preventative and

predictive analytics solutions as part of an overall compliance system may serve

to reduce potential liability when wrongdoing is discovered,” according to

Ed

Rial, a principal at Deloitte Financial Advisory Services LLP and Deloitte’s

U.S. Investigations leader.*

The Importance of Listening

Identifying vulnerabilities to fraud and corruption through root cause analysis

— and taking corrective action by building a monitoring and sensing capability

into the organizational infrastructure — can serve to protect the organization

by preventing wrongful conduct before it takes hold. “Analytics now present the

ability to discern faint signals that may represent outlier conduct across large

and diverse data sets,” adds Rial.

“While there is plenty of talk about big data solutions, not everybody

understands what that means: It requires the organizational openness to hearing

what the data is saying, rather than heeding preconceived notions about key risk

indicators,” notes Doug Veivia, vice president at Prudential Financial and a

member of Prudential’s international insurance compliance team. “To be ready to

accept what the data is indicating is critical. Sometimes the toughest challenge

is having the right people with the requisite business knowledge and openness to

approaching problems and being informed in different ways. And data analytics

helps address that challenge.”

Building an Analytics Program for Detection of Fraud and Corruption

When starting to build an analytics program for fraud detection, it’s critical

that the organization know what it is trying to solve for, settle on key

questions to address, and determine the scope: If the analytics program seeks to

solve every issue the organization faces, it could start running in circles with

no output.

“Building an analytics program requires strategic planning, a road map and a

combination of people, technology and well-thought-out goals,” says

Satish Lalchand, a principal at Deloitte Transactions and Business Analytics

LLP and Deloitte Forensic’s analytics leader.** “There is no single tool that is

a silver bullet with respect to the issue. Rather, is it is a solution built

around a strategy,” he adds.

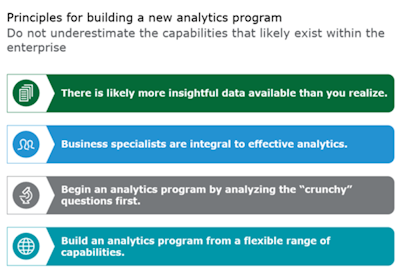

Four basic principles govern the building of a new analytics program (see chart

below). But it is important to keep in mind that such programs are not just

about data scientists, technology, software, or infrastructure; but rather the

people who have the insight. “A lot of this work still involves intuition and

the experience of having worked in the industry for long time and gaining the

core forensic skills required to understand when a problem is rising,” says Rial.

“To get started, an organization might consider performing a self-assessment in

order to establish a baseline of where it stands with respect to the type of

analytics it’s using, if it’s using any at all,” suggests Lalchand.

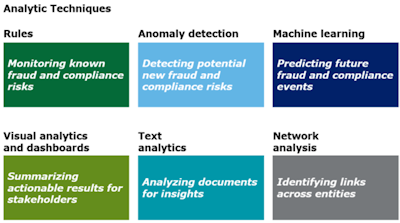

In general, there are six broad analytics techniques that organizations can

consider when building an analytics program: Rules, anomaly detection, machine

learning, visual analytics and dashboards, text analytics, and network analysis.

An organization can

use analytics techniques and build models in many ways, and using a combination

rather than just one may be better. “For example, there are many rules-based

approaches to flagging certain behaviors that are designed to address a specific

compliance or regulatory risk within the financial services industry. But for

the most part, these approaches are inflexible; they flag only behaviors that

are relatively easy to circumvent, and they are limited by the human bias that

is deciding what the rule is,” notes Fancher.

As an example of the benefits of using more than one analytics technique, one

organization wanted a model that not only would identify customer complaints,

but also predict when one might occur. The model began with identifying

customers who had submitted complaints, and via an application of predictive

analytics and text analytics, the model was able to analyze various aspects of

the behavior of those employees who were the subject of the complaints. The

model also looked at data such as commissions, earnings reprimands, and

compliance issues, and, ultimately, could predict whether an employee might be

associated with a certain type of fraud complaint.

“From a financial services perspective, two main goals tend to drive an

organization’s selection of which types of analytics capabilities to use,” notes

Veivia. “The first is protecting its customers, and the second is driving sales

growth. Having greater sensing ability can allow the organization to identify

troubling behaviors earlier — before there is real customer impact and then

regulatory — to inform how risk-monitoring rules should change going forward,”

he adds, noting that financial misconduct or criminal activity tends to evolve

over time.

“As we place procedures and controls in place, the conduct will evolve to

circumvent those controls. So what’s best for risk management is having an

ability to detect changing behavior that can then be identified or sensed

earlier, and addressed,” says Veivia.

Arriving at mature analytics is a measured journey. “Once an organization

understands the end goal, it can build a strategy and a roadmap for the

different capabilities it seeks,” suggests Lalchand. “The organization could

then take concrete steps, such as conducting pilots, working with smaller chunks

of data, or experimenting with models before making any larger decisions around

tools and approach,” he adds.

It’s important to note that when an organization does obtain findings through

analytics techniques, these findings merely represent leads. Further

confirmation is needed to identify that fraud is actually occurring. “But once

fraud is confirmed, the organization can feed the cases it has researched back

into the model — and thereby make the model more agile and smarter,” says Rial.

*Ed Rial and Don Fancher are

Deloitte Risk and Financial Advisory principals in the Forensic practice of

Deloitte Financial Advisory Services LLP.

**Satish Lalchand is a

Deloitte Risk and Financial Advisory principal in the Analytics practice of

Deloitte Transactions and Business Analytics LLP.

This article was originally published on

wsj.com

|