|

Cashierless

Stores Make Inroads in U.S.

Sam’s Club,

Giant Eagle and others are exploring the use of AI systems

after Amazon Go paved the way

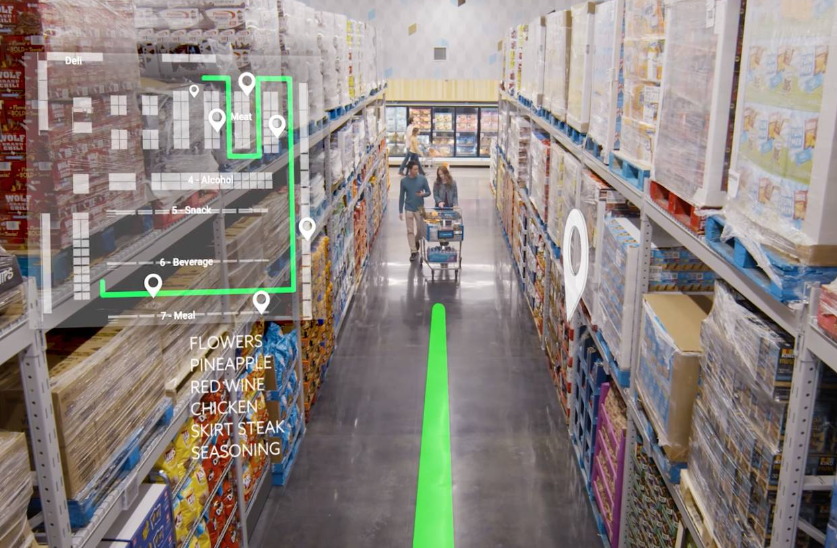

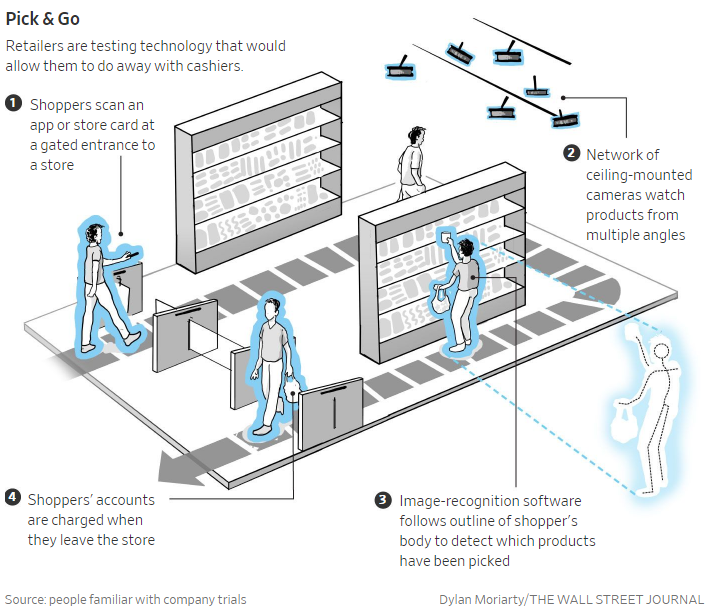

U.S. retailers large and small are pressing ahead

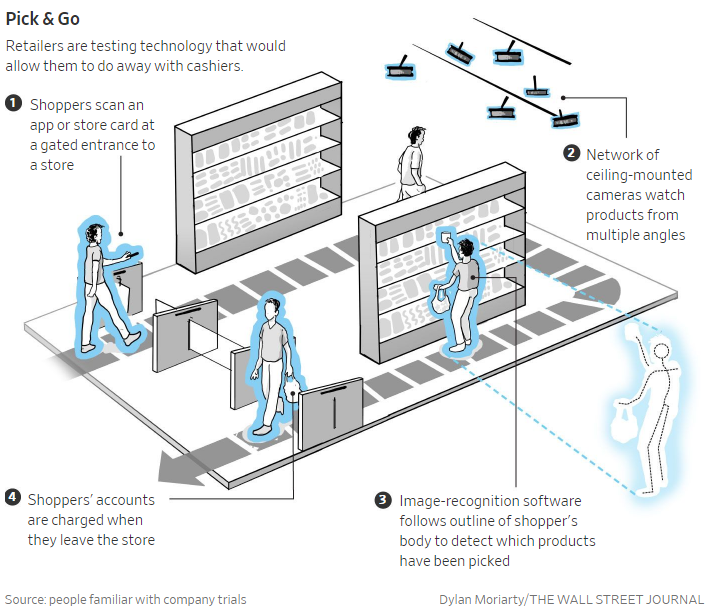

with testing the use of artificial intelligence to track what products shoppers

pick up and to automatically bill their accounts when they walk out the door,

eliminating the need for checkout lines.

The concept got a push from Amazon Go stores, which

Amazon.com Inc.

launched in early 2018; there are now 15 stores, with two opening last week,

in New York and San Francisco. Amazon Go relies on hundreds of cameras and

sensors in each store to identify products that customers take off the shelves.

Shoppers typically scan a code to enter the stores.

Recent AI adopters include Sam’s Club Inc., the warehouse retailer owned by

Walmart Inc., and Giant

Eagle Inc., a regional chain of grocery and convenience stores. Giant Eagle said

last month that it would test a technology similar to Amazon Go’s at a

convenience store in Pittsburgh, where it is based. Several companies that sell

cashierless technology—including Standard Cognition Inc. and Vcognition

Technologies Inc., which does business as Zippin—said they are working with U.S.

customers but declined to give details.

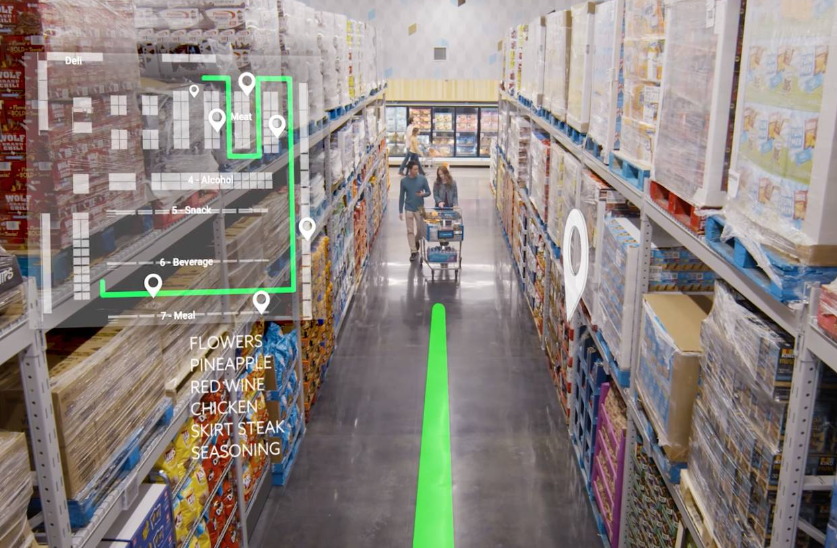

Sam’s Club plans to offer AI-powered cashierless shopping later this month at a

32,000-square-foot store in Dallas, a quarter of the size of its average store.

Currently, customers shop at the store by scanning barcodes on the products, an

older cashierless-checkout technology. Once the AI system is in place, customers

will use their smartphone cameras to scan the product itself. The cloud-based

system, which uses computer vision and machine learning, recognizes products by

matching them to a database of stored images. This is different from Amazon Go,

where cameras installed in the stores do the work of scanning the products.

Customers at the Sam’s Club store can’t pay using cash at the register, as they

can in certain Amazon Go stores.

A global survey of about 400 retailers conducted in June by research and

advisory firm International Data Corp. found that 28% are testing or piloting

cashierless systems, said Leslie Hand, vice president of IDC’s Retail Insights

division. Ms. Hand said she knows of nearly 100 companies world-wide that are

trying out the systems, adding she can’t discuss the details because of

nondisclosure agreements.

“It’s awoken that fire for retailers to understand that really this is the

future of retail and they need to invest in it,” Ms. Hand said.

Cashierless technology is

being tested by U.K.-based

Tesco PLC and

France-based Carrefour

SA . Tesco has said its method costs a tenth of systems used by its competitors,

partly because it uses only cameras, not sensors.

Not every type of store is suited for cashierless

technology. Walmart tried out a cashierless system based on scanning barcodes

for about six months in more than 100 stores but discontinued it in April 2018.

The technology proved impractical for pricing produce and other items that had

to be taken to a cashier to be weighed, causing delays, a spokesman said.

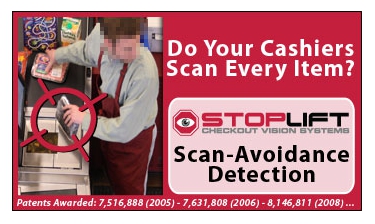

Theft is also a concern. Manual scanning operates on an honor system and some

customers don’t scan every item, often requiring stores to validate purchases,

said Richard Crone, chief executive of Crone Consulting LLC, an advisory firm

focused on retail, convenience and restaurant businesses. In the Sam’s Club

trial, for example, an employee checks customer purchases as shoppers exit,

though the clerk samples just one product per customer to see if it’s listed on

the electronic receipt.

Still, the potential benefits include speed and convenience. Even small

companies are testing the waters.

Choice Market Holdings LLC, which operates a Denver convenience store focused on

fresh food, plans to open another location next month and is developing three

others. It plans to introduce a cashierless system, using in-store cameras and

sensors, in two of the planned stores next year, said Mike Fogarty, Choice

Market’s founder and CEO.

The company is considering technology providers including AVA retail Inc. for

the project.

“This technology will allow us to extend our hours with little to no labor,

which leads to more transactions,” Mr. Fogarty said.

AVA retail CEO Atul Hirpara said his company’s system virtually eliminates

retail fraud such as price-tag switching, shoplifting and “sweethearting” by

checkout clerks who deliberately don’t charge a customer for a purchase.

Mr. Hirpara said planning, installing and deploying a typical system costs

between $300,000 and $400,000 but the price could rise to $800,000 for a

2,000-square-foot store. Annual maintenance and service costs between $25,000

and $45,000, he said. He said the error rate is one or two per 1,000 purchases.

Mr. Fogarty said Choice Market expects its costs would be at the lower end of

AVA’s estimates because the stores won’t be retrofitted but rather built with

the technology integrated into the design.

Amazon Go’s, AVA’s and other cashierless systems don’t use facial recognition to

identify customers. Instead, the systems track customers’ movements in the store

and link to their online accounts. Sensors installed on store shelves augment

the computer-vision systems by providing data on the weight of items lifted from

shelves to help the AI count the number of items purchased.

Corrections & Amplifications

The Sam’s Club cashierless test store in Dallas doesn’t accept cash payments. An

earlier version of this article said it would accept cash. Also, the store

currently lets customers check out without a cashier by having them scan

barcodes on products; it will introduce an artificial-intelligence system this

month that will allow customers to use their smartphone cameras to scan the

product itself. An earlier version of this article didn’t make it clear the

store is already operating. Sam’s Club announced the AI-powered cashierless

system in March. An earlier version of this article said it was in July. (Aug.

12, 2019)

Article originally published on

wsj.com

|