|

|

|

But might COVID-19 also be having a psychological impact on how and when consumers make payments? Has there been a change in attitude when it comes to choosing a payment method and the preferences when it comes to the checkout experience? And if so will this shift be permanent? In order to answer these questions, we surveyed 8,000 consumers from the US, UK, Canada, Germany, Austria, Italy, and Bulgaria on how COVID-19 has altered their priorities when selecting a payment method, as well as their physical habits.

Other data from this research can be found here.

Security is valued

more than convenience

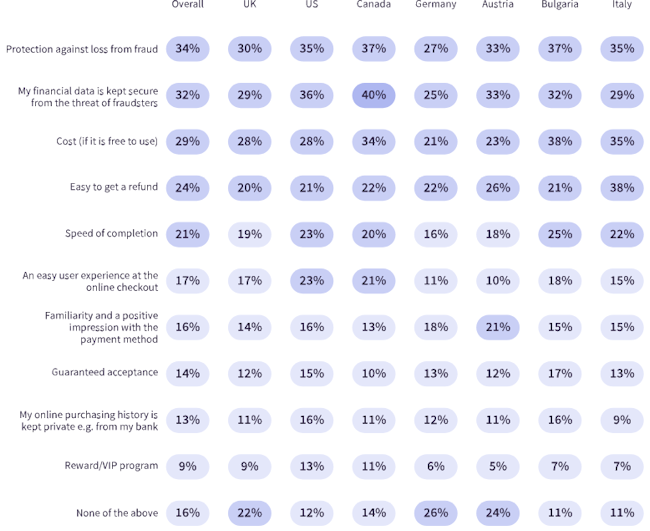

The convenience of online payments has become a more pressing priority for some consumers, including the speed of completion (for 21% of consumers) and the ease of the checkout user experience (for 17% of consumers). However, in every country the percentage of consumers that said this was a growing concern was lower than the percentage that were more focused on security.

Q: When weighing up convenience vs. security of financial data when making a purchase online, what element of risk would you be willing to accept? A role for alternative payments So it is clear that for consumers overall, security is the greater priority over convenience, and that this trend has been enhanced by COVID-19. And this is reflected in many consumer attitudes to the security of payments generally, beginning with the perceived risk associated with eCommerce. 56% of consumers say that they accept there is a risk of being a victim of fraud if they shop online (only 18% do not accept this), and 48% say that they are more concerned about being a victim of fraud than they were a year go (only 21% say that they are not more concerned). Only a third of consumers (34%) are more confident in the security of online payments than card-present payments. But it is not true that this focus on security automatically means convenience has to be compromised. 48% of consumers said they did not feel comfortable entering their financial details online to pay on an unknown website, but 68% said that they were more likely to shop with businesses where their financial details had already been securely stored. Is biometrics the answer to security vs. convenience?

One further security improvement worth considering is the

introduction of biometric payment authentication, particularly when it comes

to mCommerce. But while there is some support for this more convenient (and

arguably more secure) method of payment verification, consumers are still

somewhat concerned that this level of security is not strong enough to

protect their financial data. Although

53% of consumers do think that

biometric authentication makes payments more secure, 41% say they trust

manual passwords more than biometrics and 59% say they feel anxious when

they aren’t asked to provide a password when making a payment. So as online

businesses continue to develop their mCommerce platform,

educating

consumers on the security, as well as the convenience,

benefits of

biometric authentication will be imperative. |

|

|

|

|

&uuid=(email))

&uuid=(email))

&uuid=(email))