Walmart Responds to FTC's

Fraud Lawsuit

FTC Lawsuit Against Walmart is Unfounded and Ignores the Billions Walmart has

Saved Customers

A

narrowly divided Federal Trade Commission (“FTC”) has

filed a misguided lawsuit

against Walmart regarding money transfer services

that the Company offers to consumers. Here’s what you need to know about the

lawsuit:

A

narrowly divided Federal Trade Commission (“FTC”) has

filed a misguided lawsuit

against Walmart regarding money transfer services

that the Company offers to consumers. Here’s what you need to know about the

lawsuit:

Since Walmart began offering our customers flat, low fee money transfer services

at our stores,

the company has saved

consumers—particularly the unbanked and underbanked— an estimated $6 billion in

fees by bringing

important competition to the money transfer industry.

Walmart has a robust

anti-fraud program to help stop third-party criminals

who try to use money transfer services to commit fraud, and only a miniscule

number of transactions are even alleged to be fraudulent. In fact, Walmart has

stopped hundreds of thousands of suspicious transactions totaling hundreds of

millions of dollars.

Despite Walmart’s anti-fraud programs,

the FTC is trying to blame the

Company for actions by third parties,

including fraud the FTC has already acknowledged was caused by another

company—while that company was under federal government oversight through a

compliance monitor, and during a period when that company’s own fraud prevention

system had failed.

This civil lawsuit is factually misguided and legally flawed. In fact, it was

approved by the FTC by the narrowest of margins after Chair Lina Khan

refused Walmart the due

process of hearing directly from the company,

and then the Department of Justice refused to take this case to court.

Despite

the fact that the Justice Department took a pass on this lawsuit and two of the

FTC’s own Commissioners voted against it, the FTC has unfortunately chosen to

pursue a misguided lawsuit that

distorts existing law by

attempting to hold Walmart strictly liable for the wrongdoing of third-party

criminals, despite all

our efforts to stop fraudsters.

Despite

the fact that the Justice Department took a pass on this lawsuit and two of the

FTC’s own Commissioners voted against it, the FTC has unfortunately chosen to

pursue a misguided lawsuit that

distorts existing law by

attempting to hold Walmart strictly liable for the wrongdoing of third-party

criminals, despite all

our efforts to stop fraudsters.

Walmart will defend against this lawsuit aggressively.

Pro-consumer competition in the money transfer industry is too important to be

threatened by the unfortunate decisions of a few Commissioners of the FTC, and

Walmart remains focused on fighting fraud and delivering low prices to our

customers.

Keep reading to learn more about how Walmart has disrupted the money transfer

market to help consumers, how Walmart fights fraud, and the problems with the

FTC’s lawsuit.

How Walmart Disrupted the

Money Transfer Market and Saved Consumers Billions

Walmart is dedicated to serving our customers by providing everyday low prices

to help people live better. We are proud to offer customers convenient and

budget-friendly one-stop shopping and services that are accessible to all. As

part of delivering on that mission, Walmart offers a number of financial

services in-store, including money orders, bill payment, check cashing, gift

cards, branded credit cards, and money transfers—the financial service product

that is the subject of the FTC’s lawsuit.

Money transfers are just one component of our overall business. They provide an

important service to millions of customers who are often excluded from

traditional financial services, and rely on Walmart to send or receive money

from family and friends.

Walmart serves as an “agent” of other companies that actually transmit the money

from one location to the other. Walmart first began offering money transfers as

a MoneyGram agent in 2005, and later became an agent for Western Union.

Over time, Walmart saw an opportunity to lower prices for our customers by

introducing a white label money transfer service. In 2014,

Walmart partnered as an agent for Ria to launch Walmart2Walmart, a new

low-cost money transfer service built around transparent, everyday low prices.

This new service gave consumers another choice to send or receive cash in a

market that had been dominated for years by MoneyGram and Western Union. As

explained in the

Wall Street Journal, by offering money transfer fees “as much as 87%

below the competition,” Walmart’s innovative and disruptive entry into the money

transfer business has been especially beneficial to “financially vulnerable”

unbanked and underbanked consumers who often lack access to traditional

financial services.

In addition to saving our own customers an estimated

$2.4 billion in fees since launching Walmart2Walmart, our entry into the

market caused MoneyGram and Western Union to cut their prices, saving consumers

an estimated additional $4 billion in fees.

How Walmart Helps Fight Fraud

While saving consumers billions by shaking up the money transfer market, Walmart

has also worked hard to keep those same consumers safe by helping stop

third-party criminals from using money transfers to scam customers. And

Walmart’s efforts are working. Walmart has stopped hundreds of thousands of

suspicious transactions totaling hundreds of millions of dollars. Our efforts

have been incredibly effective, resulting in fewer than 2 out of every 10,000

money transfers at Walmart being reported as possibly fraudulent in 2021. Below

are some notable steps that Walmart takes to ensure that customers can feel

confident using our financial services products.

Walmart Works with Law

Enforcement, Non-Profit, and Private Sector Partners to Combat Fraud

Walmart routinely works with law enforcement and government agencies to stop

fraud and other crime. The Company has made significant contributions to

enforcement efforts, and has been recognized by various regulators and law

enforcement agencies.

For example, after detecting a fraud trend in Colorado, Walmart started an

investigation and worked with law enforcement to apprehend a fraudster who

scammed victims across several states. DOJ ultimately charged the fraudster with

defrauding victims out of more than

$3 million through a property rental scam.

More recently,

CNBC reported that technology developed by Walmart helped the Company

identify and freeze millions of dollars in suspected gift card fraud, and

Walmart turned those funds over to law enforcement—keeping them out of the hands

of fraudsters and helping the government support fraud victims.

Walmart also works with corporate and non-profit partners to help prevent

financial services fraud. For example:

●

Walmart shares information

about trends and patterns in reported fraud with money transfer principals

MoneyGram, Ria, and Western Union.

●

Walmart participates on the

Strategic Board of Advisors for the Knoble, a non-profit network of financial

crime experts, on an initiative to combat financial services fraud.

Walmart Educates Customers to Help Prevent Fraud

Walmart provides warnings and customer-facing resources to help our customers

recognize frauds and scams before they fall victim. These resources are

available in Walmart Money Centers and online.

In-Store

Warnings

●

Walmart has customer-facing

fraud warnings in our stores to raise consumers’ awareness and prevent fraud.

●

Walmart provides fraud

awareness brochures in English and Spanish.

●

Walmart plays fraud warning

videos in more than 3,700 stores on prominent big-screen televisions in the

money center or at the customer service desk. These videos provide information

about various specific scam types.

●

Walmart also provides

customers a printout prior to money transfers being completed (or disbursed

electronically if the money transfer is staged online or via a MoneyCenter

kiosk). This printout contains warnings about fraud and contact information for

reporting fraud.

Online Resources

●

Consumers who initiate money

transfers online are also warned about potential scams.

Walmart’s webpage dedicated to money transfers contains a comprehensive

fraud warning, which educates customers about telemarketing scams, how to

recognize when they may be the target of a scam (like if they have been asked to

make a transfer in order to receive lottery winnings, or to pay the IRS or

police to get out of a warrant), and how to submit a complaint to MoneyGram, Ria,

Western Union, and/or the FTC. The warning also contains links to helpful

resources, including the IRS’s “Common Tax Scams” page, the FTC’s article “How

to Avoid A Scam,” and a report from the National Council on Aging entitled “Top

10 Financial Scams Targeting Seniors.” This information is available on the

money transfer home page, educating customers before they even begin the process

of sending a transfer.

●

Walmart also has an entire

section of our website dedicated to

fraud information, which includes, among other things, information on

various frauds and scams, such as government imposter scams, grandparent scams,

and tech support scams. The fraud webpage also educates consumers on techniques

fraudsters may use and tips on how to avoid fraud—such as not providing gift

card numbers over the phone. It also includes a link to the FTC’s fraud report

website (reportfraud.ftc.gov),

and encourages customers concerned that they may have been defrauded to contact

the FTC or the Consumer Fraud Division of the customer’s state’s Attorney

General’s office.

Walmart

Trains our Associates to Help Fight Fraud

Walmart associates are part of a large team dedicated to preventing fraud.

Before Walmart associates can process money transfers, they must complete

computer-based anti-fraud training. Each year they go through additional

computer-based training on Walmart’s financial services compliance procedures

and how to apply those procedures to identify, prevent, and report fraud and

other suspicious activity. Walmart has developed our own register “lock-out”

function so that associates who are not current on required training cannot

process money transfers.

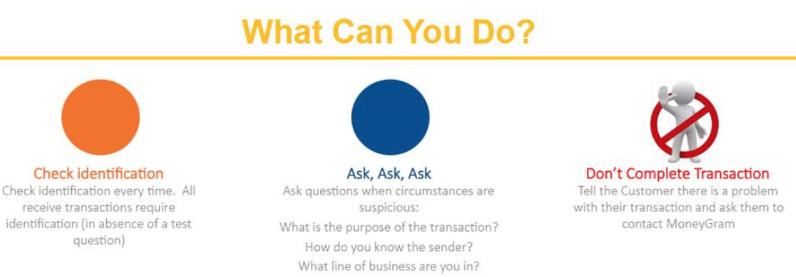

Through Walmart’s anti-fraud training, associates who process financial services

transactions are trained to recognize red flags suggesting potential fraud, such

as customers who are on the telephone with someone instructing them to send

money, customers who are concerned about an emergency situation, or customers

who have not met the sender or receiver of a money transfer. Walmart also trains

associates to ask customers questions, such as how they know the receiver and

why they are sending money. And associates are trained not to process the

transaction if they suspect fraud.

Associates are also prompted to ask specifically whether customers are

conducting a money transfer based on outreach from a telemarketer. If the

customer says that he or she is sending money to pay for a telemarketing

purchase, Walmart’s point of contact services system (“POCS”) terminates the

transaction.

In addition to annual computer-based training, Walmart takes other steps to

educate associates about fraud, including:

●

Providing telephonic

trainings;

●

Providing on-site store

trainings;

●

Providing other anti-fraud

messaging to Walmart associates throughout the year, such as before the holiday

season or tax season when the risk of fraud might be higher;

●

Displaying information about

consumer fraud reports for a particular store on the POCS, which is the screen

associates use to process financial services transactions;

●

Making training documents

available on the POCS so associates can learn to prevent common types of

fraudulent transactions; and

●

Displaying a daily knowledge

check question through the POCS that appears when associates sign into their

register, thus providing a resource for continuing education on fraud

prevention.

Walmart’s Consumer Fraud Team and Fraud Monitoring

Within our Financial Services Compliance team, Walmart has a Consumer Fraud Team

dedicated to anti-fraud measures including, but not limited to, the following:

●

Analyzing information about

money transfers to identify stores where associates may need additional

training;

●

Analyzing information about

money transfers and fraud reports to determine whether associates should be

alerted about particular fraud types or trends; and

●

Visiting and evaluating stores

based on risk and recommending remediation as needed.

●

Visiting and evaluating stores

based on risk and recommending remediation as needed.

Walmart uses fraud controls along with other aspects of our comprehensive

program to prevent fraud. Two primary controls are Walmart’s proprietary Store

Referrals (STaR), real-time interdiction tool, and customer blocking.

●

STaR:

Walmart developed STaR (formerly known as eMSAR), a proprietary tool designed to

enable associates to easily report and prevent fraud. The STaR screen on the

POCS allows associates to report and stop suspicious transactions, and it has

been used to stop at least 450,000 suspicious transactions as of May 2022,

totaling more than $740 million.

●

Blocking & Interdiction:

On a regular basis, the Consumer Fraud Team reviews money transfers reported as

fraud and adds known receivers of reported fraud-induced transfers to a block

list.

What’s Wrong with the FTC’s Misguided Lawsuit

The FTC’s complaint distorts the facts and the law to try and hold Walmart

responsible for a miniscule amount of reported fraud, even though we had an

extensive program to try to stop such fraud, and continuously improve our

anti-fraud efforts to this day. While the FTC faults Walmart for not stopping

every reportedly fraud-induced transfer, the fact is that Walmart has worked

hard to stop fraud and our associates have stopped hundreds of millions of

dollars in suspicious transactions. Below are just some of the problems with the

FTC’s lawsuit:

Shifting Blame

One major flaw with the FTC’s lawsuit is that it tries to shift blame to Walmart

for reported fraud the FTC itself has already said was caused by a money

transfer principal—and that happened while that company was under a federal

government compliance monitor. Specifically:

●

In 2018, the FTC publicly said

that a money transfer company failed to prevent millions in fraud because it did

not do what it was supposed to under a 2009 consent order with the FTC.

●

Much of the reported fraud the

FTC cites in its complaint against Walmart occurred when,

according to the FTC, a principal’s interdiction system—its program for

blocking potential fraud—was not working for 18 months.

●

The company’s fraud

interdiction system was supposed to hold and prevent the payout of potentially

fraud-induced money transfers, and the FTC acknowledged that the 18-month system

failure allowed millions of dollars in fraud-induced money transfers to be

processed.

●

That massive system failure

happened while the money transfer company was under federal government

oversight, including the FTC consent order and a federal government compliance

monitor. Today, the FTC tries to shift the blame to Walmart for what it has

already said were another company’s failures—which happened on the government’s

watch.

Truth about Training

Another big problem with the FTC’s lawsuit is that it wrongly claims that

Walmart did not train associates to deny payouts to suspected fraudsters.

●

This claim appears to be

largely based on an apparent typo on one page of a training document from

years ago, and is in spite of the fact that other trainings at Walmart

instructed exactly the opposite of what FTC claims.

●

You can look at Walmart’s

training and judge for yourself—below is just one vivid example of how Walmart

empowered associates to stop fraud.

End-run Around the Supreme

Court

Not only is the FTC’s complaint untethered to the facts, but it is also based on

a flawed and novel legal theory that the FTC is pursuing after a landmark

Supreme Court case said the FTC had been ignoring the law for decades.

●

The FTC originally focused on

pursuing Walmart under Section 13(b) of the FTC Act. But that became a problem

for the FTC when the Supreme Court ruled on April 22, 2021 that for decades, the

FTC had been wrongly using Section 13(b) to seek monetary remedies without

authority. See AMG Capital Mgmt., LLC v. FTC, 141 S. Ct. 1341 (2021).

●

The fact is Congress never

gave the FTC the authority under Section 13(b) to threaten companies with claims

for massive monetary amounts (or any monetary amounts). Instead, Section 13(b)

allows the FTC to ask a court to impose “injunctive relief,” ordering a

defendant to stop engaging in improper conduct.

●

Except in Walmart’s case, as

we described above, Walmart’s anti-fraud efforts are already robust, so there is

no need for injunctive relief requiring Walmart to change. Walmart has never

been in the business of scamming consumers or intentionally enabling fraudsters

to scam our customers, so there is no improper Walmart conduct for a court to

block.

●

But the FTC appears more

interested in chasing headlines and big dollars, rather than working with

companies like Walmart to fight fraud.

●

Thus, the FTC pivoted their

focus in this case after AMG to a distorted interpretation of the “Telemarketing

Sales Rule” to effectively try and hold Walmart strictly liable for money

transfers that third-party criminals reportedly persuaded some consumers to

send. Switching their main legal theory to the “Telemarketing Sales Rule” is an

obvious attempt to get around the Supreme Court’s ruling in AMG.

●

The FTC has never litigated

the “Telemarketing Sales Rule” in the controversial way it’s now doing in the

agency’s new lawsuit against us. The “Telemarketing Sales Rule” is designed to

regulate telemarketers. But there’s no allegation Walmart was a telemarketer and

Walmart was not in league with illegal telemarketers. To the contrary, Walmart

fights very hard to block telemarketers and scammers and help law enforcement

put scammers behind bars.

●

Instead, the FTC has distorted

the law to claim that whenever a fraudster is successful scamming a victim,

Walmart—rather than the third-party scammer—should be on the hook for the money

victims lost to the scammer, even though Walmart tried hard to stop the

scammers. The FTC’s legal theory is called “strict liability,” and it just isn’t

supported by the law.

●

We believe the courts will see

the FTC’s lawsuit for what it is: an unprecedented and unfair end-run around the

Supreme Court to attempt to expand the Commission’s authority far beyond what

any statute or its own rules allow.

●

In fact, Chair Khan

recently gave an interview where she made clear that under her leadership,

the FTC is ready to bring lawsuits the FTC will lose—and will bring those

lawsuits not to enforce existing law, but rather to change the law.

What’s Next?

Walmart is going to keep doing what we have been doing—working to provide

customers with important financial services at low, transparent prices. We are

going to continue working hard to prevent third-party criminals from using money

transfers to defraud consumers. And we are going to defend ourselves vigorously

against this lawsuit. The FTC’s decision to pursue Walmart raises serious

questions, including about the government’s own conduct. Among other things, we

want to know how MoneyGram’s colossal interdiction system failure could have

happened—for 18 months—while MoneyGram was supposed to be under government

supervision. We want to know when and how the government found out about this

failure, and what if anything the government did to warn customers and MoneyGram

agents like Walmart about this failure. We have already started asking those

questions through a

FOIA request we filed weeks ago.

In the meantime, we will keep focusing our attention where it belongs—on

improving the lives of our customers.

Walmart's response originally posted

here